Introduction

NPV Risk Modelling, an acronym for Net Present Value Risk Modelling, is a powerful analytical tool used in finance and investment analysis. It enables organizations to assess the financial viability and risks associated with investment projects by incorporating uncertainties and variations in cash flows over time. In this comprehensive article, we delve into the intricacies of NPV Risk Modelling, exploring its benefits, key components, methodologies, and practical applications.

I. Understanding NPV Risk Modelling

1.1 Defining NPV Risk Modelling

NPV Risk Modelling, also known as Net Present Value Risk Modelling, is a sophisticated analytical technique used to assess the financial viability and risks associated with investment projects. It combines the principles of net present value (NPV) analysis with the incorporation of uncertainties and variations in cash flows over time. By integrating risk factors into the analysis, NPV Risk Modelling provides a more comprehensive understanding of the potential outcomes and helps decision-makers make more informed choices.

NPV Risk Modelling involves the application of mathematical and statistical models to evaluate the probability of achieving a certain level of return on investment. It considers not only the projected cash flows but also the likelihood of those cash flows materializing under different scenarios and the time value of money.

1.2 Importance of NPV Risk Modelling in Financial Decision-Making

NPV Risk Modelling plays a crucial role in financial decision-making for several reasons. Here are some key aspects highlighting its importance:

- 1.2.1 Comprehensive Assessment of Investment Viability: NPV Risk Modelling allows organizations to evaluate the financial feasibility of investment projects in a more comprehensive manner. By incorporating uncertainties and risks, it provides a realistic view of potential outcomes, enabling decision-makers to assess the likelihood of achieving desired returns.

- 1.2.2 Risk Mitigation and Enhanced Risk Management: By explicitly considering risks and uncertainties, NPV Risk Modelling helps organizations identify and assess potential sources of risk. This enables proactive risk mitigation strategies and enhances overall risk management, reducing the likelihood of unexpected negative outcomes.

- 1.2.3 Better Resource Allocation: NPV Risk Modelling aids in optimizing resource allocation by providing insights into the potential returns and risks associated with different investment options. It assists in comparing and prioritizing projects based on their expected net present values and associated risks, facilitating efficient allocation of financial resources.

- 1.2.4 Informed Decision-Making: NPV Risk Modelling equips decision-makers with the necessary information to make well-informed choices. By quantifying risks and uncertainties, it enables a more objective evaluation of investment projects, minimizing biases and subjective decision-making.

- 1.2.5 Communication and Stakeholder Engagement: NPV Risk Modelling facilitates effective communication with stakeholders by presenting a clear picture of the potential financial outcomes and associated risks. This enhances transparency and supports collaborative decision-making processes.

- 1.2.6 Regulatory Compliance and Investor Confidence: In certain industries and jurisdictions, NPV Risk Modelling is essential for regulatory compliance. It provides a structured approach to evaluate investment proposals, demonstrating due diligence and adherence to risk management practices. This, in turn, can instill confidence in investors and regulatory authorities.

- 1.2.7 Continuous Improvement and Learning: NPV Risk Modelling encourages organizations to continually refine their financial decision-making processes. By monitoring and analyzing actual project outcomes against predicted results, organizations can learn from past experiences and improve the accuracy of future NPV Risk Modelling analyses.

In summary, NPV Risk Modelling is a valuable tool in financial decision-making. By considering uncertainties and risks, it provides a comprehensive assessment of investment viability, facilitates risk mitigation strategies, supports efficient resource allocation, enables informed decision-making, enhances communication with stakeholders, ensures regulatory compliance, and promotes continuous improvement in financial analysis processes.

II. Key Components of NPV Risk Modelling

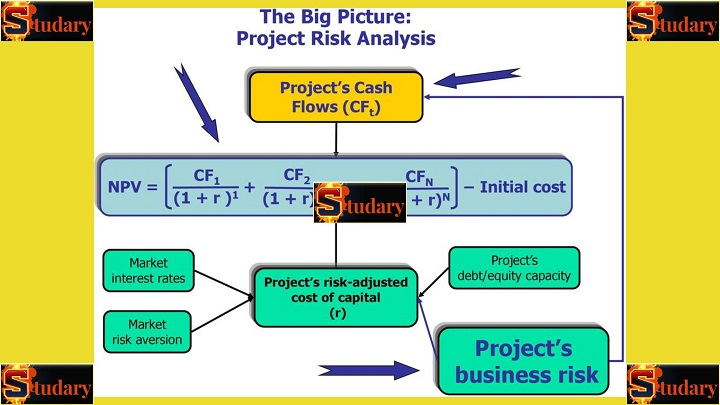

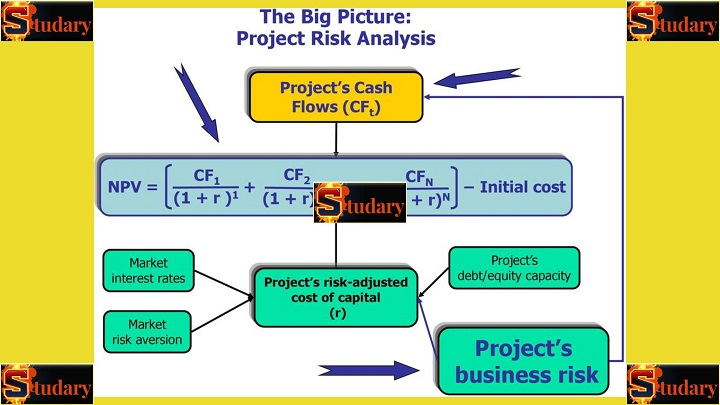

2.1 Cash Flow Projection:

Cash flow projection is a fundamental component of NPV Risk Modelling. It involves estimating the future cash inflows and outflows associated with an investment project over its projected lifespan. Cash flow projections consider factors such as sales revenue, operating expenses, taxes, capital expenditures, working capital requirements, and potential cash inflows from the project. Accurate cash flow projections are crucial as they form the basis for calculating the net present value and evaluating the financial feasibility of the investment.

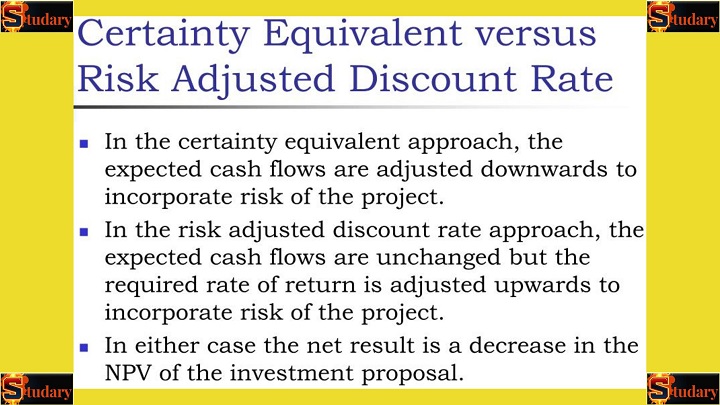

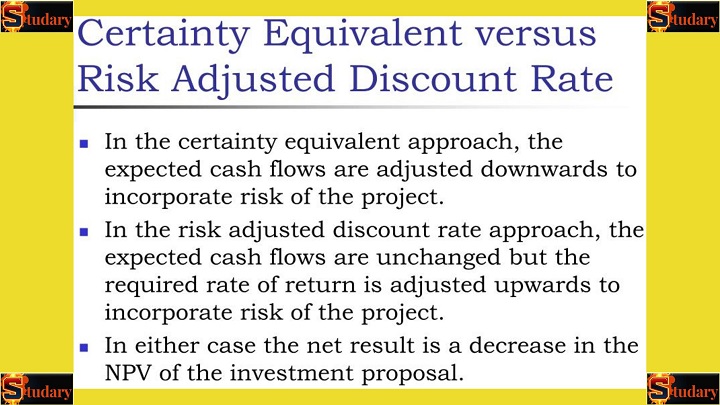

2.2 Discount Rate Determination:

The discount rate is another critical component of NPV Risk Modelling. It represents the rate of return required by an investor to compensate for the time value of money and the associated risks. The discount rate is typically based on the company's cost of capital or the required rate of return expected by investors. It reflects the opportunity cost of investing in the project and accounts for factors such as inflation, market conditions, and the risk profile of the investment. Accurately determining the discount rate ensures that the NPV calculation appropriately reflects the time value of money and risk considerations.

2.3 Risk Assessment and Probability Distribution:

Risk assessment is an essential step in NPV Risk Modelling. It involves identifying and quantifying the various risks and uncertainties associated with the investment project. Risks can arise from factors such as market conditions, competition, technological changes, regulatory changes, and operational challenges. In NPV Risk Modelling, these risks are typically quantified using probability distributions. Probability distributions assign probabilities to different potential outcomes, allowing for a more nuanced analysis of the potential range of cash flows and their associated probabilities. Risk assessment and probability distribution help to capture the inherent uncertainty in future cash flows and enable a more accurate evaluation of investment viability.

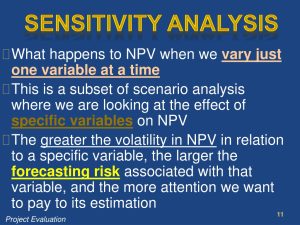

2.4 Scenario Analysis and Sensitivity Testing:

Scenario analysis and sensitivity testing are techniques used to assess the impact of different scenarios and key variables on the NPV of an investment project. Scenario analysis involves evaluating multiple scenarios by changing various inputs, such as sales volumes, costs, or market conditions, to understand how they affect the project's cash flows and NPV. This analysis provides insights into the project's robustness and resilience under different conditions. Sensitivity testing, on the other hand, focuses on evaluating the project's sensitivity to changes in specific variables or assumptions. By systematically adjusting key variables and assessing their impact on the NPV, sensitivity testing helps identify the most critical factors driving project profitability and risk.

In conclusion, the key components of NPV Risk Modelling include cash flow projection, discount rate determination, risk assessment, probability distribution, scenario analysis, and sensitivity testing. These components collectively contribute to a comprehensive analysis of investment viability, enabling decision-makers to assess the potential financial outcomes, incorporate risk considerations, and make informed choices.

III. Methodologies for NPV Risk Modelling

NPV Risk Modelling employs various methodologies to assess the financial viability and risks associated with investment projects. These methodologies provide frameworks for incorporating uncertainties and variations in cash flows into the analysis. Here are four commonly used methodologies:

3.1 Monte Carlo Simulation:

Monte Carlo Simulation is a powerful technique used in NPV Risk Modelling to model and analyze the impact of uncertainties on project outcomes. It involves generating multiple random samples of inputs based on probability distributions and simulating the cash flows for each sample. By running a large number of simulations, Monte Carlo Simulation generates a distribution of possible NPV outcomes, allowing for a comprehensive analysis of the project's risk profile. This technique accounts for the interdependencies of different variables and provides insights into the probability of achieving specific financial targets.

3.2 Decision Tree Analysis:

Decision Tree Analysis is a visual and analytical tool that helps evaluate complex investment decisions under uncertainty. It involves constructing a decision tree that represents different decision points, potential outcomes, and associated probabilities. Each branch of the decision tree represents a different scenario or option, and the tree's structure helps in mapping out the decision-making process. Decision Tree Analysis considers the probabilities of different outcomes at each decision point, enabling a systematic evaluation of the project's financial viability. It also helps identify the optimal decisions based on expected values or other decision criteria.

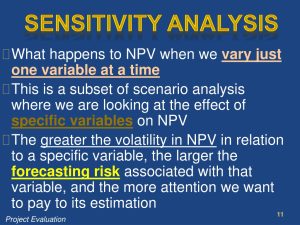

3.3 Sensitivity Analysis:

Sensitivity Analysis involves systematically varying key variables or assumptions to assess their impact on the NPV of an investment project. It helps understand the project's sensitivity to changes in different factors and identifies the most critical drivers of project profitability and risk. Sensitivity Analysis can involve one-variable-at-a-time analysis, where each variable is varied while others are held constant, or multi-variable analysis, where combinations of variables are tested. By examining how changes in variables affect the project's NPV, Sensitivity Analysis provides insights into the project's robustness and guides decision-making based on different scenarios.

3.4 Real Options Analysis:

Real Options Analysis extends traditional NPV analysis by incorporating the value of flexibility and the ability to make future strategic decisions. It recognizes that investment projects often come with embedded options, such as the option to expand, defer, or abandon the project based on changing market conditions. Real Options Analysis quantifies the value of these options and their impact on the project's NPV. This methodology allows decision-makers to assess the potential value of flexibility and adaptability in uncertain environments, providing a more comprehensive evaluation of investment opportunities.

In summary, NPV Risk Modelling utilizes various methodologies such as Monte Carlo Simulation, Decision Tree Analysis, Sensitivity Analysis, and Real Options Analysis. These methodologies provide analytical frameworks to incorporate uncertainties, assess the impact of key variables, and evaluate the financial viability and risks associated with investment projects. Each methodology offers unique insights and assists decision-makers in making informed choices based on a comprehensive understanding of the project's risk profile and potential outcomes.

IV. Benefits of NPV Risk Modelling

NPV Risk Modelling offers several benefits that contribute to improved financial decision-making and risk management. Let's explore four key benefits:

4.1 Improved Decision-Making:

One of the primary benefits of NPV Risk Modelling is its ability to enhance decision-making. By incorporating uncertainties and variations in cash flows, NPV Risk Modelling provides decision-makers with a more comprehensive understanding of the potential outcomes and associated risks. It enables a quantitative assessment of investment projects, considering the probabilities of different scenarios. This allows decision-makers to evaluate the potential returns, assess the likelihood of achieving desired financial targets, and make more informed choices. NPV Risk Modelling helps in selecting the most financially viable projects and avoiding investments with high levels of risk or low expected returns.

4.2 Enhanced Risk Management:

Effective risk management is a critical aspect of financial decision-making, and NPV Risk Modelling contributes to this process. By explicitly considering risks and uncertainties, NPV Risk Modelling allows organizations to identify and assess potential sources of risk associated with investment projects. It helps in quantifying the impact of different risk factors on the project's cash flows and NPV. This enables decision-makers to proactively develop risk mitigation strategies and allocate resources accordingly. NPV Risk Modelling supports the identification, measurement, and management of risks, reducing the likelihood of unexpected negative outcomes and improving the organization's overall risk management practices.

4.3 Optimal Resource Allocation:

Optimal resource allocation is essential for organizations to allocate their financial resources effectively. NPV Risk Modelling assists in this process by providing insights into the potential returns and risks associated with different investment options. By comparing and prioritizing projects based on their expected net present values and associated risks, NPV Risk Modelling aids in making informed resource allocation decisions. It helps organizations direct their financial resources towards projects with higher expected returns and acceptable risk levels. This ensures that resources are utilized efficiently, maximizing the organization's financial performance.

4.4 Communication of Project Viability:

NPV Risk Modelling facilitates effective communication of the financial viability of investment projects to stakeholders. By quantifying uncertainties and risks, NPV Risk Modelling provides a clear picture of the potential financial outcomes and associated probabilities. This enhances transparency and enables meaningful discussions and decision-making processes with stakeholders, such as senior management, investors, or regulatory authorities. The use of visual representations, sensitivity analyses, and scenario analysis aids in conveying the project's risk profile and potential financial outcomes. Effective communication supported by NPV Risk Modelling promotes stakeholder understanding, engagement, and alignment with the organization's strategic objectives.

In conclusion, NPV Risk Modelling offers several benefits, including improved decision-making, enhanced risk management, optimal resource allocation, and effective communication of project viability. By incorporating uncertainties and variations in cash flows, NPV Risk Modelling provides decision-makers with a comprehensive understanding of investment viability and associated risks. This supports informed decision-making, proactive risk management, efficient resource allocation, and stakeholder engagement. Overall, NPV Risk Modelling strengthens financial analysis and enables organizations to make sound investment decisions in a dynamic and uncertain business environment.

V. Steps Involved in NPV Risk Modelling

NPV Risk Modelling involves a systematic process to evaluate the financial viability and risks associated with investment projects. The following steps outline the key stages involved in NPV Risk Modelling:

5.1 Define the Investment Project and Objectives:

The first step in NPV Risk Modelling is to clearly define the investment project and establish its objectives. This includes identifying the scope, purpose, and expected outcomes of the project. Defining the project and its objectives provides a foundation for subsequent analysis and ensures that the NPV Risk Modelling aligns with the organization's strategic goals.

5.2 Gather Historical Data and Identify Key Assumptions:

The next step is to gather relevant historical data and identify key assumptions for the project. Historical data includes financial records, market data, industry trends, and other relevant information. Key assumptions are the factors that drive the project's cash flows, such as sales growth rates, cost structures, inflation rates, and discount rates. It is crucial to gather accurate and reliable data to form the basis for subsequent analysis and projections.

5.3 Develop Cash Flow Projections:

Based on the historical data and key assumptions, the next step is to develop cash flow projections for the investment project. Cash flow projections estimate the future cash inflows and outflows associated with the project over its projected lifespan. This involves forecasting revenues, costs, taxes, capital expenditures, working capital requirements, and any other relevant cash flows. Cash flow projections should consider different scenarios and potential variations to account for uncertainties and risks.

5.4 Assign Probability Distributions and Assess Risks:

After developing cash flow projections, the next step is to assign probability distributions to the key variables and assess the associated risks. Probability distributions represent the likelihood of different outcomes for each variable. This involves analyzing historical data, market trends, expert opinions, and other relevant information to determine the probabilities. Risk assessment involves identifying and quantifying the potential risks and uncertainties associated with the project. This step helps capture the inherent uncertainty in cash flow projections and provides a more realistic assessment of investment viability.

5.5 Perform NPV Risk Modelling Analysis:

In this step, NPV Risk Modelling analysis is performed by combining the cash flow projections, probability distributions, and risk assessment. Various methodologies, such as Monte Carlo Simulation or Decision Tree Analysis, may be employed to calculate the project's NPV under different scenarios or decision options. This analysis incorporates the uncertainties and risks to determine the project's expected net present value and assess the probability of achieving specific financial targets.

5.6 Interpret Results and Make Informed Decisions:

The final step involves interpreting the results of the NPV Risk Modelling analysis and making informed decisions. Decision-makers review the NPV outcomes, risk profiles, and other relevant information to assess the project's financial viability and risks. This information helps in evaluating the project's alignment with the organization's objectives, risk appetite, and strategic priorities. By considering the NPV outcomes, risk assessment, and other relevant factors, decision-makers can make informed choices regarding the project's acceptance, rejection, or potential modifications.

In conclusion, the steps involved in NPV Risk Modelling include defining the investment project and objectives, gathering historical data and identifying key assumptions, developing cash flow projections, assigning probability distributions and assessing risks, performing NPV Risk Modelling analysis, and interpreting the results to make informed decisions. This systematic process ensures a comprehensive evaluation of investment viability, incorporating uncertainties and risks to guide decision-making and optimize financial outcomes.

VI. Practical Applications of NPV Risk Modelling

NPV Risk Modelling is a versatile analytical tool that finds practical applications in various domains. Its ability to incorporate uncertainties and assess the risks associated with investment projects makes it valuable in different financial decision-making processes. Let's explore some practical applications of NPV Risk Modelling:

6.1 Capital Budgeting and Project Evaluation:

Capital budgeting involves evaluating and selecting investment projects that generate long-term returns. NPV Risk Modelling is extensively used in capital budgeting to assess the financial viability of potential projects. By incorporating uncertainties and variations in cash flows, NPV Risk Modelling helps organizations prioritize and allocate resources to projects with higher expected net present values and acceptable levels of risk. It provides a comprehensive evaluation of investment options, assists in comparing different projects, and supports decision-making on resource allocation.

6.2 Merger and Acquisition Analysis:

NPV Risk Modelling plays a crucial role in merger and acquisition (M&A) analysis. It aids organizations in evaluating the financial feasibility and risks associated with potential M&A transactions. By incorporating uncertainties, cash flow projections, and probability distributions, NPV Risk Modelling provides insights into the expected financial outcomes of the transaction. It helps organizations assess the potential synergies, estimate the impact of market and operational risks, and determine the appropriate valuation for the target company. NPV Risk Modelling assists in making informed decisions regarding M&A transactions and mitigating risks associated with such strategic initiatives.

6.3 Portfolio Management and Asset Allocation:

NPV Risk Modelling is valuable in portfolio management and asset allocation decisions. It helps organizations assess the risk-return trade-offs of different investment options and optimize their portfolio compositions. By incorporating the risks and uncertainties of individual investments, NPV Risk Modelling enables organizations to construct portfolios that align with their risk tolerance and return objectives. It aids in diversifying investments, balancing asset classes, and managing portfolio risk. NPV Risk Modelling assists portfolio managers in making informed decisions about including or excluding specific assets or investment strategies based on their expected net present values and associated risks.

6.4 Risk Assessment for New Ventures:

When assessing new ventures or business initiatives, NPV Risk Modelling helps organizations evaluate their financial viability and associated risks. It aids in assessing the potential returns and risks of launching new products, entering new markets, or exploring innovative business opportunities. By incorporating uncertainties and variations in cash flows, NPV Risk Modelling provides a comprehensive understanding of the financial outcomes and risk profiles associated with new ventures. This analysis assists organizations in making informed decisions about pursuing or modifying new ventures, considering their alignment with strategic objectives, risk appetite, and expected financial returns.

6.5 Valuation of Real Estate and Infrastructure Projects:

NPV Risk Modelling is applicable in the valuation of real estate and infrastructure projects. It assists in estimating the financial viability and risks associated with property development, construction projects, or infrastructure investments. By incorporating uncertainties and variations in cash flows, NPV Risk Modelling provides a realistic assessment of the potential financial outcomes and risk profiles of these projects. It aids in determining the appropriate valuation, considering factors such as project costs, rental incomes, market conditions, construction risks, and financing considerations. NPV Risk Modelling supports investors, developers, and stakeholders in making informed decisions regarding real estate and infrastructure investments.

In conclusion, NPV Risk Modelling finds practical applications in capital budgeting, merger and acquisition analysis, portfolio management, risk assessment for new ventures, and valuation of real estate and infrastructure projects. By incorporating uncertainties and assessing risks, NPV Risk Modelling enables organizations to make informed financial decisions, evaluate risks, and optimize investment outcomes. These practical applications highlight the versatility and significance of NPV Risk Modelling in different sectors, supporting strategic decision-making and enhancing financial analysis processes.

VII. Challenges and Limitations of NPV Risk Modelling

While NPV Risk Modelling is a valuable tool in

financial decision-making, it is important to be aware of the challenges and limitations associated with its application. The following are some key challenges and limitations to consider:

7.1 Data Limitations and Accuracy:

One of the primary challenges in NPV Risk Modelling is the availability and accuracy of data. The accuracy of the model's output heavily relies on the quality and reliability of the input data. Gathering comprehensive and reliable historical data, market data, and other relevant information can be challenging, especially for new or innovative projects. Moreover, there may be limitations in the availability of data for estimating probability distributions, making it necessary to rely on assumptions or expert judgments. Inaccurate or incomplete data can undermine the reliability of the model's results and impact the validity of the conclusions drawn.

7.2 Assumptions and Subjectivity:

NPV Risk Modelling involves making assumptions about various factors, including growth rates, cost estimates, discount rates, and market conditions. These assumptions are subjective and can introduce a level of uncertainty and bias into the analysis. Different analysts may have different opinions or perspectives, leading to variations in the results. Additionally, assumptions may not accurately capture the complexities of real-world situations, leading to potential inaccuracies in the model's projections. It is important to be transparent about the assumptions made and consider their potential impact on the model's outcomes.

7.3 Model Complexity and Time Constraints:

NPV Risk Modelling can become complex, particularly when dealing with multiple variables, scenarios, and probability distributions. Managing the complexity of the model and its computations requires expertise and time. Developing and maintaining sophisticated models may be resource-intensive and time-consuming. Additionally, time constraints can limit the ability to perform a comprehensive analysis. This can lead to simplifications or shortcuts in the modelling process, which may impact the accuracy and reliability of the results. Striking a balance between complexity, accuracy, and practicality is essential in NPV Risk Modelling.

7.4 Uncertainty in External Factors:

NPV Risk Modelling assumes that the future will follow the same patterns as observed in historical data. However, it is challenging to predict future market conditions, technological advancements, regulatory changes, or other external factors that can significantly impact project cash flows. These uncertainties introduce inherent limitations to the accuracy of NPV Risk Modelling. Organizations need to carefully consider the potential impact of external factors, perform sensitivity analyses, and regularly update their models to reflect changing circumstances.

In conclusion, NPV Risk Modelling faces challenges and limitations related to data limitations and accuracy, assumptions and subjectivity, model complexity and time constraints, as well as uncertainty in external factors. It is crucial to recognize these limitations and exercise caution when interpreting the results of NPV Risk Modelling. Organizations should continuously refine their models, validate assumptions, seek diverse perspectives, and account for uncertainties to mitigate the potential impact of these challenges. By acknowledging and addressing these limitations, decision-makers can make more informed judgments based on a comprehensive understanding of the risks and uncertainties involved in financial decision-making processes.

VIII. Best Practices for NPV Risk Modelling

To enhance the effectiveness and reliability of NPV Risk Modelling, it is important to follow best practices. These practices help mitigate potential limitations and ensure a more robust analysis. Here are some key best practices for NPV Risk Modelling:

8.1 Use Reliable and Accurate Data:

Start by using reliable and accurate data as the foundation of your NPV Risk Modelling. Gather historical data, market data, and other relevant information from credible sources. Ensure the data is comprehensive, up-to-date, and accurately represents the variables being analyzed. Avoid relying solely on outdated or incomplete data, as it can lead to biased or inaccurate results. Use data validation techniques to verify the accuracy and consistency of the data before incorporating it into the modelling process.

8.2 Incorporate Expert Opinions and Diverse Perspectives:

Incorporate expert opinions and seek diverse perspectives when developing NPV Risk Models. Engage professionals with domain expertise who can provide insights into the industry, market trends, and relevant risk factors. Encourage collaborative discussions to capture a wide range of viewpoints and challenge assumptions. By considering diverse perspectives, you can improve the accuracy of assumptions, enhance the robustness of the model, and reduce the impact of biases or blind spots.

8.3 Validate and Calibrate Models:

Validate and calibrate your NPV Risk Models to ensure they accurately represent the underlying financial dynamics and risk factors. Conduct sensitivity analyses and compare model outputs against historical data or known outcomes to verify the model's accuracy. Calibration involves adjusting the model's parameters to align with observed market behaviors or empirical evidence. Validation and calibration help establish confidence in the model's predictive capabilities and enhance its reliability.

8.4 Regularly Update and Review Assumptions:

Assumptions play a critical role in NPV Risk Modelling. Regularly review and update assumptions to reflect changing market conditions, technological advancements, regulatory changes, or other relevant factors. Establish a process to periodically reassess assumptions based on new information and evolving circumstances. Incorporate feedback from stakeholders and subject matter experts to ensure the assumptions remain realistic and up-to-date. Document and justify any changes made to the assumptions, ensuring transparency and accountability.

8.5 Communicate Results and Limitations Effectively:

Communicate the results of your NPV Risk Modelling analysis in a clear and concise manner. Present the findings, including the NPV outcomes, risk profiles, and sensitivity analysis, in a format that is easily understandable for stakeholders. Clearly communicate any limitations or uncertainties associated with the model, including data limitations, assumptions, and external factors. Provide context and insights into the model's strengths and weaknesses to enable informed decision-making. Effective communication builds trust and fosters collaboration among stakeholders.

In conclusion, following best practices enhances the reliability and effectiveness of NPV Risk Modelling. Use reliable and accurate data, incorporate expert opinions, validate and calibrate models, regularly update assumptions, and communicate results and limitations effectively. By adopting these best practices, organizations can improve the accuracy of their NPV Risk Modelling analyses, enhance decision-making processes, and mitigate potential limitations and risks. It is important to continually review and refine the modelling approach based on feedback, new information, and evolving market dynamics to ensure the ongoing effectiveness of NPV Risk Modelling practices.

Conclusion

NPV Risk Modelling is a valuable tool that aids organizations in making informed financial decisions by integrating risk and uncertainty into project evaluations. By considering multiple scenarios and assessing the impact of various factors on cash flows, it provides a comprehensive understanding of investment viability and associated risks. Despite its challenges and limitations, NPV Risk Modelling continues to evolve and play a crucial role in guiding strategic decision-making processes across various industries. As organizations strive for effective risk management and optimal resource allocation, NPV Risk Modelling stands as a powerful ally, enhancing financial analysis and facilitating better outcomes.

Comments are closed!