When making personal investment decisions, calculating the Net Present Value (NPV) can be useful to assess an investment opportunity's financial viability and potential profitability. Here's a step-by-step guide on how to calculate NPV for personal investment decisions:

Identify the investment opportunity

Identifying the specific investment opportunity is a crucial step in the NPV calculation process. The investment opportunity can vary based on your personal circumstances, risk tolerance, and investment goals. Here are a few examples of investment opportunities:- Purchasing a property: This could involve buying a residential property to generate rental income or purchasing a commercial property for business purposes.

- Investing in a business: You may consider investing in an existing business or starting your own venture. This could involve purchasing equity in a company or providing capital for business expansion.

- Buying stocks: Investing in publicly traded stocks allows you to become a shareholder in a company and participate in its financial performance.

- Investing in mutual funds or exchange-traded funds (ETFs): These investment options allow you to invest in a diversified portfolio of stocks, bonds, or other assets.

- Investing in fixed-income securities: This could include purchasing government bonds, corporate bonds, or certificates of deposit (CDs) that provide a fixed interest income over a specific period.

- Investing in real estate investment trusts (REITs): REITs are companies that own and manage income-generating real estate properties, offering opportunities for real estate investment without direct property ownership.

- Investing in cryptocurrencies or digital assets: This emerging investment option involves buying and holding digital currencies such as Bitcoin or investing in blockchain-based projects.

- Investing in retirement accounts: Contributing to retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, can provide long-term investment growth and potential tax advantages.

Estimate cash inflows

When estimating cash inflows for your investment opportunity, consider the potential sources of income or cash receipts that the investment is expected to generate over its lifespan. Here are some common examples of cash inflows to consider:- Rental income: If the investment involves property, estimate the rental income you expect to receive from tenants. Consider factors such as rental rates in the area, occupancy rates, and any potential rental increases over time.

- Dividend income: If you are investing in stocks, consider the dividends you expect to receive from the companies in which you hold shares. Research the dividend history of the companies and their dividend payout policies.

- Interest payments: If you are investing in fixed-income securities such as bonds or certificates of deposit, estimate the interest payments you expect to receive periodically. Consider the interest rate, coupon payments, and the duration of the investment.

- Business profits: If you are investing in a business, estimate the potential profits the business is expected to generate. Consider the business's revenue projections, cost structure, and profit margins.

- Capital gains: If you plan to sell the investment at a later date, consider the potential capital gains or profits from the sale. This applies to investments such as real estate, stocks, or other assets that may appreciate in value over time.

- Royalties or licensing fees: If your investment involves intellectual property or patents, estimate the potential royalties or licensing fees you expect to receive from licensing agreements or product sales.

- Loan repayments: If you are providing loans or financing, estimate the cash inflows from loan repayments, including principal and interest payments.

- Other revenue streams: Depending on the specific investment opportunity, there may be other potential revenue streams to consider. For example, if you are investing in a renewable energy project, estimate the revenue from selling electricity generated.

Read Also: Capital Budgeting Techniques in Predicting Future Cash Flows

Estimate cash outflows

When estimating cash outflows for your investment, it's important to consider all the expected expenses and cash payments associated with the investment. Here are some common examples of cash outflows to consider:- Initial investment cost: This includes the upfront cost required to acquire the investment. For example, if you are purchasing a property, it would involve the purchase price, closing costs, and any associated fees or expenses.

- Ongoing maintenance and repairs: Consider the regular maintenance and repair costs that you will incur to keep the investment in good condition. This can include expenses such as property repairs, equipment maintenance, or vehicle upkeep.

- Operating expenses: Estimate the recurring operating expenses necessary to run the investment. This can include costs such as utilities, insurance premiums, property taxes, advertising and marketing expenses, employee salaries, or raw material costs.

- Financing costs: If you are financing the investment through loans or credit, consider the interest payments and fees associated with the financing. This can include mortgage interest, loan origination fees, or credit card interest.

- Property management fees: If you are investing in rental properties or real estate, factor in the costs associated with property management services, such as leasing fees or property management fees.

- Regulatory or compliance costs: Depending on the nature of the investment, there may be regulatory or compliance-related expenses. Consider costs associated with permits, licenses, legal fees, or compliance with industry regulations.

- Depreciation or amortization: For certain assets, such as buildings or equipment, account for the depreciation or amortization expense over their useful life. This reflects the gradual reduction in value or the allocation of costs over time.

- Contingency funds: It's prudent to set aside a portion of cash outflows as a contingency fund to account for unexpected expenses or emergencies that may arise during the investment's lifespan.

- Exit costs: If you anticipate selling or exiting the investment at a future date, consider any associated costs such as real estate agent fees, legal fees, or other transaction-related expenses.

- Taxes: Estimate the taxes payable on the investment, such as property taxes, capital gains taxes, or income taxes, depending on the investment type and jurisdiction.

-

Determine the appropriate discount rate

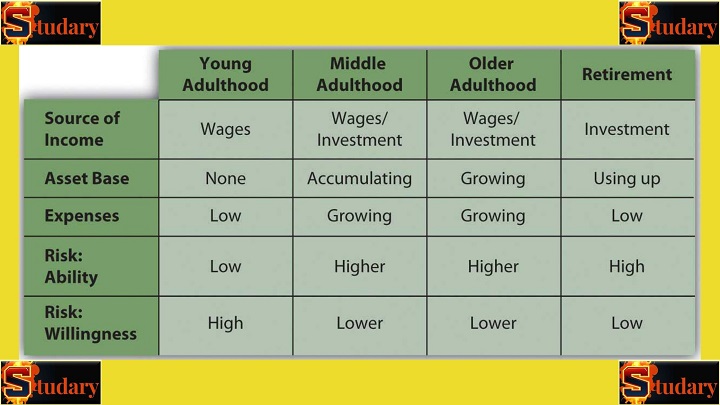

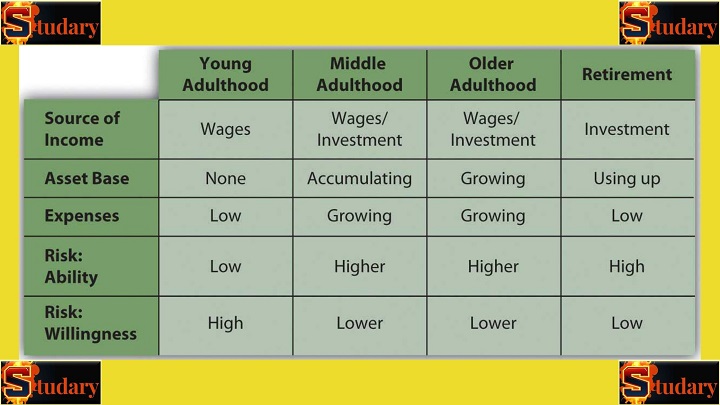

- Risk tolerance: Assess your personal risk tolerance and the level of risk associated with the investment. Generally, investments with higher risk should have higher discount rates to reflect the additional risk exposure.

- Opportunity cost of capital: Consider the alternative investment opportunities available to you and the potential returns they offer. The discount rate should account for the opportunity cost of allocating your capital to this particular investment rather than other options.

- Inflation: Take into account the expected inflation rate over the investment's time horizon. The discount rate should incorporate an inflation premium to maintain the purchasing power of future cash flows.

- Market rates of return: Research prevailing market rates of return for investments with similar risk profiles. This can provide a benchmark for determining an appropriate discount rate.

- Investment-specific factors: Evaluate factors specific to the investment, such as industry trends, market conditions, and the investment's historical performance. These factors can help gauge the riskiness of the investment and influence the discount rate.

- Time horizon: Consider the length of the investment's lifespan. Generally, longer-term investments require higher discount rates to account for the increased uncertainty and potential risks associated with future cash flows.

- Personal financial goals: Align the discount rate with your personal financial goals. If you have specific return objectives or investment targets, the discount rate should reflect those goals.

- Professional advice: Seek guidance from financial advisors or experts who can provide insights into selecting an appropriate discount rate based on your investment objectives and risk appetite.

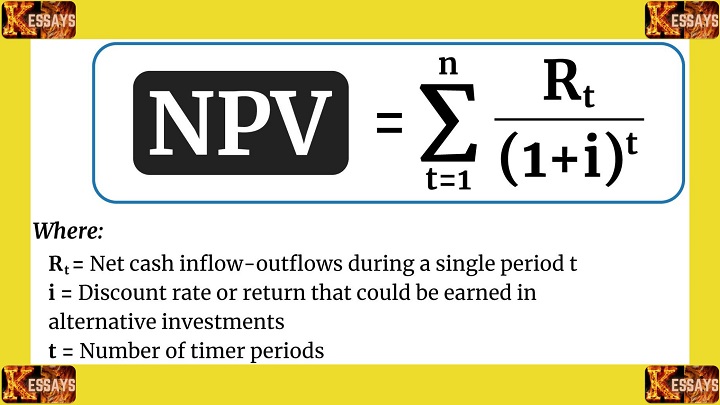

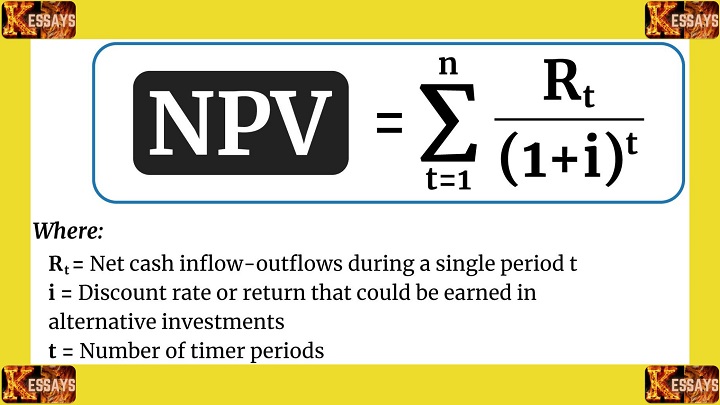

Calculate the present value of cash flows

To calculate the present value of cash flows, you can use the formula PV = CF / (1 + r)^n, where PV is the present value, CF is the cash flow, r is the discount rate, and n is the number of periods into the future. Here's how you can apply this formula to each cash flow:- Identify each individual cash flow: Start by listing out each estimated cash inflow and outflow associated with the investment over its lifespan. Assign a positive sign to cash inflows and a negative sign to cash outflows to indicate the direction of the cash flow.

- Determine the corresponding period: Determine the number of periods into the future for each cash flow. This represents the time between the present and when the cash flow is expected to be received or paid.

- Calculate the present value: For each cash flow, divide the cash flow (CF) by (1 + r)^n, where r is the selected discount rate and n is the number of periods into the future. This calculation discounts the cash flow to its present value.

- Repeat the calculation for each cash flow: Apply the PV = CF / (1 + r)^n formula to each cash flow to calculate its respective present value.

- Sum the present values: Add up all the present values of the cash flows to obtain the total present value of the investment. This represents the net present value (NPV) of the investment.

Sum the present values

To calculate the net present value (NPV), you need to sum up the present values of all the expected cash inflows and outflows. The formula for NPV is: NPV = Sum of PV (cash inflows) - Sum of PV (cash outflows) Here's how you can calculate the NPV:- Calculate the present value for each cash inflow: Apply the formula PV = CF / (1 + r)^n to each cash inflow using the selected discount rate. This will give you the present value of each cash inflow.

- Calculate the present value for each cash outflow: Similarly, apply the formula PV = CF / (1 + r)^n to each cash outflow using the same discount rate. This will give you the present value of each cash outflow.

- Sum up the present values of cash inflows: Add up all the present values of the cash inflows to obtain the total present value of the expected cash inflows.

- Sum up the present values of cash outflows: Add up all the present values of the cash outflows to obtain the total present value of the expected cash outflows.

- Calculate the NPV: Subtract the total present value of cash outflows from the total present value of cash inflows. The result will be the net present value (NPV) of the investment.

Evaluate the NPV

If the calculated NPV is positive, it indicates that the investment is expected to generate more cash inflows than outflows, and it may be considered financially viable. A positive NPV implies that the investment is expected to add value and generate a surplus of cash inflows over the required rate of return. Conversely, a negative NPV suggests that the investment may not be financially attractive, as the expected cash outflows exceed the inflows. When evaluating the NPV, consider the following:- Magnitude of the NPV: A larger positive NPV indicates a higher potential for profitability and value creation. Conversely, a larger negative NPV suggests a higher level of risk or potential loss.

- Comparison to the required rate of return: Compare the calculated NPV to the required rate of return or minimum acceptable rate of return for the investment. If the NPV is greater than zero and exceeds the required rate of return, it suggests that the investment has the potential to meet or exceed your financial goals.

- Sensitivity analysis: Conduct sensitivity analysis by varying the key assumptions used in the cash flow projections and discount rate. Assess how changes in these variables impact the NPV. This analysis helps understand the robustness of the investment and its sensitivity to different scenarios.

- Consideration of other factors: Evaluate other qualitative and quantitative factors alongside the NPV. These may include strategic fit, market conditions, competitive landscape, regulatory factors, and your personal investment objectives.

Consider qualitative factors

When evaluating an investment opportunity, it's crucial to consider qualitative factors alongside quantitative metrics such as the NPV. Qualitative factors provide valuable insights into the broader aspects of the investment and help assess its feasibility and alignment with your personal investment goals. Here are some key qualitative factors to consider:- Risk assessment: Evaluate the risks associated with the investment, including market risks, operational risks, regulatory risks, and financial risks. Assess the likelihood and potential impact of these risks on the investment's performance and financial outcomes.

- Market conditions: Analyze the current market conditions and industry trends relevant to the investment. Consider factors such as market growth potential, competitive landscape, customer demand, and technological advancements. Understanding the market dynamics helps determine the investment's potential for success and growth.

- Management team: Assess the competence and experience of the management team or the individuals responsible for executing the investment. Consider their track record, industry expertise, and ability to navigate challenges. A strong management team can significantly influence the investment's success.

- Competitive advantage: Evaluate whether the investment offers a competitive advantage or unique value proposition. Assess factors such as intellectual property, brand reputation, distribution channels, or cost advantages. A sustainable competitive advantage can contribute to long-term success and profitability.

- Scalability and growth potential: Consider the potential for future growth and scalability of the investment. Evaluate factors such as market size, customer base, product/service demand, and expansion opportunities. Assess whether the investment has the potential to generate increasing cash flows over time.

- Alignment with personal goals: Evaluate how the investment aligns with your personal investment goals, risk tolerance, and time horizon. Consider whether the investment supports your financial objectives, lifestyle aspirations, and overall investment portfolio strategy.

- Environmental, social, and governance (ESG) factors: Assess the investment's impact on environmental, social, and governance factors. Consider sustainability, ethical considerations, corporate social responsibility, and adherence to regulatory standards. This evaluation can align your investment decisions with your values and contribute to long-term sustainability.

- Exit strategy: Evaluate the potential exit options for the investment. Consider factors such as market liquidity, potential buyers or investors, and the expected return on investment upon exit. Assessing the exit strategy ensures that you have a clear plan to realize the investment's value when desired.

Repeat for different scenarios

Conducting NPV calculations for different scenarios or performing sensitivity analysis is an effective way to account for uncertainty and assess the investment's robustness. By adjusting key variables, you can evaluate the impact on the net present value (NPV) and understand how the investment's performance may vary under different conditions. Here's how you can incorporate scenario analysis or sensitivity analysis into your evaluation:- Identify key variables: Identify the variables that significantly impact the investment's cash flows and profitability. These variables can include sales growth rates, inflation rates, cost assumptions, market conditions, or any other factors specific to your investment.

- Define different scenarios: Create different scenarios by adjusting one variable at a time while keeping others constant. For example, you can have a base case scenario, an optimistic scenario, and a pessimistic scenario. Each scenario should reflect a plausible range of outcomes for the identified variables.

- Adjust cash flow projections: Modify the cash flow projections for each scenario based on the changes in the identified variables. Consider the potential impact on cash inflows and outflows and adjust the estimates accordingly.

- Calculate NPV for each scenario: Apply the same NPV calculation methodology used earlier to determine the NPV for each scenario. Use the modified cash flow projections and the selected discount rate for each scenario.

- Evaluate and compare results: Assess the NPV results for each scenario and compare them to the base case scenario. Analyze the variations in NPV and consider the implications for investment viability and decision-making. This analysis helps identify the scenarios that yield the most favorable outcomes and those that pose higher risks or uncertainties.

- Sensitivity analysis: In addition to scenario analysis, you can also conduct sensitivity analysis by systematically varying multiple variables simultaneously. This allows you to understand the combined impact of multiple factors on the NPV and assess the investment's sensitivity to changes in those variables.

Make an informed decision

Finally, based on the calculated NPV, qualitative factors, and your personal investment objectives, make an informed decision about whether to proceed with the investment. After considering the calculated net present value (NPV), qualitative factors, and your personal investment objectives, it's time to make an informed decision about whether to proceed with the investment. Here are the steps to follow:- Evaluate the NPV: Consider the NPV calculated earlier, taking into account the magnitude of the NPV and its comparison to the required rate of return or minimum acceptable rate of return. A positive NPV suggests that the investment is expected to generate a surplus of cash inflows over outflows and may be financially viable. A negative NPV indicates that the investment may not meet the required rate of return and may not be financially attractive.

- Consider qualitative factors: Review the qualitative factors you assessed, such as risk assessment, market conditions, management team, competitive advantage, growth potential, and alignment with personal goals. Evaluate how these factors align with your investment objectives and risk tolerance. Consider the overall attractiveness and suitability of the investment based on these qualitative aspects.

- Weigh the risks and rewards: Assess the risks associated with the investment and compare them to the potential rewards. Consider the potential return on investment, the stability of cash flows, the market conditions, and the competitive landscape. Evaluate whether the potential benefits outweigh the potential risks and whether the investment aligns with your risk appetite.

- Review scenario analysis and sensitivity analysis: If you conducted scenario analysis or sensitivity analysis, review the results and insights gained from assessing different scenarios or varying key variables. Consider the range of outcomes and associated risks under different conditions. Evaluate the investment's flexibility and adaptability to potential changes.

- Consult with professionals: If needed, consult with financial advisors or experts who can provide additional insights and guidance. They can help you understand the nuances of the investment, analyze the financial projections, and provide an objective perspective to support your decision-making process.

- Make an informed decision: Based on the evaluation of the NPV, qualitative factors, risk-reward assessment, and professional advice, make a well-informed decision about whether to proceed with the investment. Consider your personal investment objectives, financial situation, and long-term goals. If the investment aligns with your objectives, exhibits favorable financial prospects, and meets your risk tolerance, you may decide to proceed. Conversely, if the investment poses significant risks or does not align with your goals, you may choose to decline the opportunity.