Introduction

Net Present Value (NPV) analysis is a powerful tool used in financial decision-making to assess the profitability of investment projects. It takes into account the time value of money, discounting future cash flows to their present value and comparing them to the initial investment cost. Understanding the variables in NPV analysis is crucial for making informed investment decisions and maximizing returns. In this comprehensive article, we will delve into the various variables that influence NPV analysis, providing expert insights and real-world examples.

I. Cash Flows: The Foundation of NPV Analysis

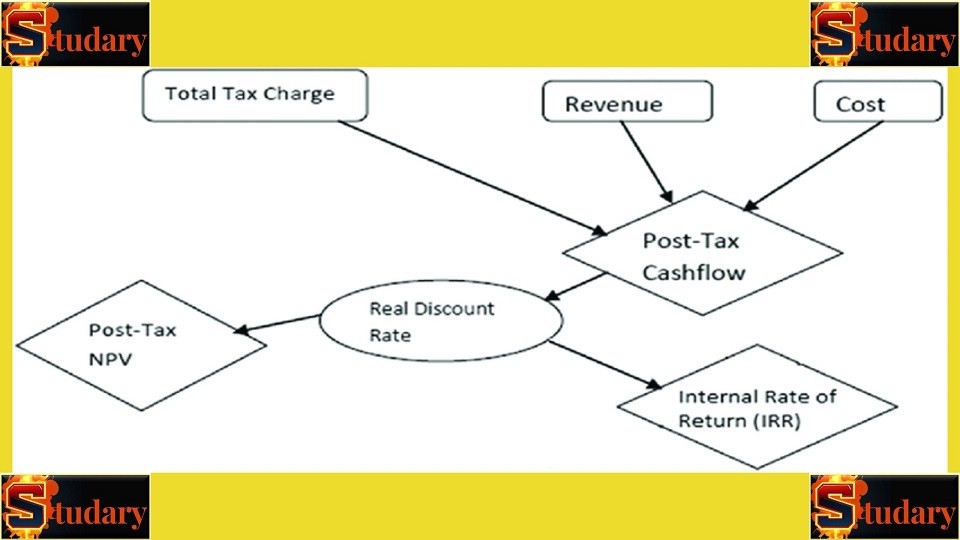

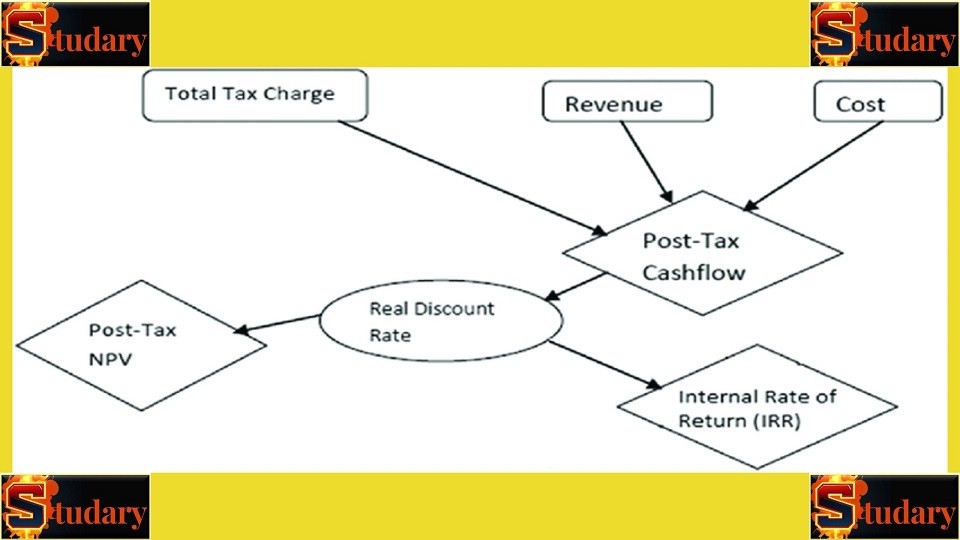

Cash flows are the lifeblood of NPV analysis. They represent the expected cash inflows and outflows generated by an investment project over its lifetime. Accurately estimating and projecting cash flows is essential for conducting a robust NPV analysis. Cash inflows include revenue from sales, rental income, royalties, or any other cash generated by the project. Cash outflows, on the other hand, encompass costs such as initial investments, operating expenses, taxes, and maintenance costs. By incorporating all relevant cash flows, NPV analysis provides a comprehensive evaluation of the project's financial viability.

Example: In a real estate development project, cash inflows can include rental income from residential or commercial properties, while cash outflows consist of construction costs, property management expenses, and taxes.

II. Discount Rate: Assessing the Time Value of Money

The discount rate is a critical variable in NPV analysis. It represents the rate of return required by investors to compensate for the time value of money and the project's risk. The discount rate reflects the opportunity cost of investing in one project over another. It considers factors such as the cost of capital, inflation, and the required rate of return based on the project's risk profile. Selecting an appropriate discount rate ensures that future cash flows are appropriately valued in today's terms.

Example: A company may use its weighted average cost of capital (WACC) as the discount rate to assess the profitability of an investment project.

III. Time Horizon: Accounting for Project Duration

The time horizon is the period over which cash flows are expected to be generated by the investment project. It is an important variable in NPV analysis as it affects the timing and magnitude of cash flows. A longer time horizon introduces greater uncertainty, as future cash flows are subject to changing economic conditions, market dynamics, and other external factors. When evaluating projects with different time horizons, it is crucial to consider the associated risks and adjust the discount rate accordingly.

Example: An infrastructure project with a time horizon of 30 years will likely face more uncertainty and economic fluctuations compared to a shorter-term project.

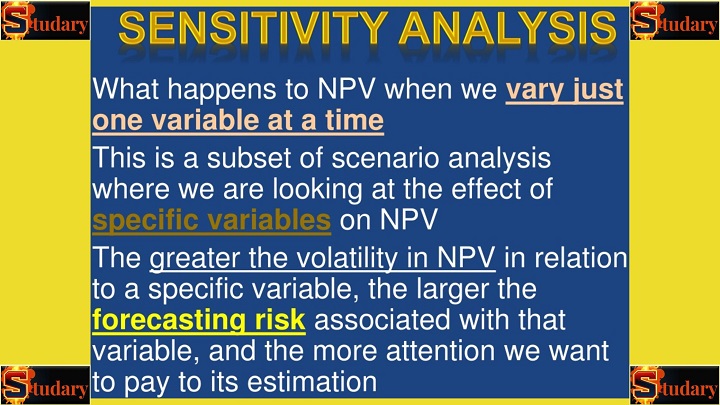

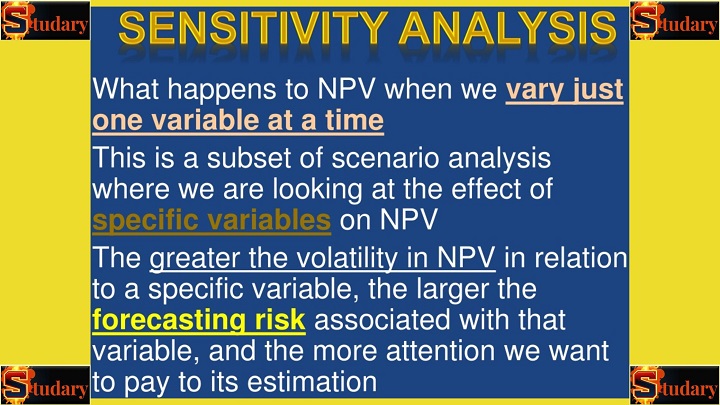

IV. Sensitivity Analysis: Assessing Risk and Uncertainty

Sensitivity analysis is a technique used to evaluate the impact of changes in key variables on the NPV of an investment project. By systematically varying the variables in NPV analysis, decision-makers can assess the project's robustness and identify critical factors that may significantly influence its profitability. Sensitivity analysis helps quantify the project's sensitivity to changes in variables such as cash inflows, cash outflows, discount rate, and other relevant factors. It enables better risk management and aids in decision-making under uncertain conditions.

Example: Sensitivity analysis may reveal that a project's NPV is highly sensitive to changes in commodity prices, indicating the need for risk mitigation strategies or hedging mechanisms.

V. Risk Assessment: Incorporating Risk Factors

Risk assessment is an integral part of NPV analysis. It involves identifying and quantifying various risks associated with the investment project. Risks can arise from factors such as market conditions, regulatory changes, technological advancements, and competitive landscape. Incorporating risk factors in NPV analysis helps stakeholders evaluate the project's risk-adjusted profitability and make informed investment decisions.

Example: When analyzing an investment project in the pharmaceutical industry, the NPV analysis should consider regulatory risks, intellectual property protection, and potential changes in healthcare policies.

VI. Opportunity Cost: Comparing Investment Alternatives

In NPV analysis, the concept of opportunity cost plays a significant role. It represents the potential return forgone by choosing one investment opportunity over another. By comparing the NPV of different projects, decision-makers can assess the relative attractiveness and select the investment option that maximizes value creation.

Example: A company considering two expansion projects can compare their respective NPVs to determine which project offers a higher return and aligns better with the company's strategic objectives.

Example:

Suppose a company is considering investing in a new manufacturing plant. The project requires an initial investment of $1,000,000. The projected cash inflows over a five-year period are as follows: Year 1 - $300,000, Year 2 - $400,000, Year 3 - $500,000, Year 4 - $600,000, Year 5 - $700,000. The discount rate used is 10%.

Step 1: Calculate the Present Value of Cash Flows

To calculate the present value of each cash inflow, we discount them using the discount rate. The formula for present value (PV) calculation is:

PV = CF / (1 + r)^n

Where CF is the cash flow, r is the discount rate, and n is the time period.

Calculating the present value of each cash inflow:

PV of Year 1 cash flow = $300,000 / (1 + 0.10)^1 = $272,727.27 PV of Year 2 cash flow = $400,000 / (1 + 0.10)^2 = $330,578.51 PV of Year 3 cash flow = $500,000 / (1 + 0.10)^3 = $413,223.14 PV of Year 4 cash flow = $600,000 / (1 + 0.10)^4 = $454,545.45 PV of Year 5 cash flow = $700,000 / (1 + 0.10)^5 = $513,429.11

Step 2: Calculate the NPV

The NPV is the sum of the present values of all cash flows minus the initial investment cost. The formula for NPV calculation is:

NPV = PV of Cash Inflows - Initial Investment

Calculating the NPV:

NPV = $272,727.27 + $330,578.51 + $413,223.14 + $454,545.45 + $513,429.11 - $1,000,000 NPV = $984,503.48 - $1,000,000 NPV = -$15,496.52

In this example, the NPV is negative, indicating that the investment project is not expected to generate returns that exceed the cost of capital. Therefore, based on the given cash flows and discount rate, the project may not be financially viable.

Sensitivity Analysis:

Performing a sensitivity analysis involves testing how changes in variables impact the NPV. Let's consider the effect of a higher discount rate on the project's viability.

Suppose we increase the discount rate to 12% while keeping all other variables unchanged. Recalculating the NPV:

PV of Year 1 cash flow = $300,000 / (1 + 0.12)^1 = $267,857.14 PV of Year 2 cash flow = $400,000 / (1 + 0.12)^2 = $289,256.20 PV of Year 3 cash flow = $500,000 / (1 + 0.12)^3 = $315,892.86 PV of Year 4 cash flow = $600,000 / (1 + 0.12)^4 = $347,222.22 PV of Year 5 cash flow = $700,000 / (1 + 0.12)^5 = $382,474.17

NPV = $267,857.14 + $289,256.20 + $315,892.86 + $347,222.22 + $382,474.17 - $1,000,000 NPV = $1,602,702.59 - $1,000,000 NPV = $602,702.59

By increasing the discount rate, the NPV becomes positive, indicating that the project may be viable under the new assumption. This

sensitivity analysis highlights the importance of carefully assessing the impact of variables on investment profitability.

In conclusion, these examples demonstrate the calculation of NPV by considering variables such as cash flows, discount rate, and sensitivity analysis. These calculations provide valuable insights into the financial viability and profitability of investment projects, aiding decision-makers in maximizing returns and making informed investment choices.

Conclusion

Variables in NPV analysis are key drivers of investment decision-making and play a vital role in maximizing returns. By understanding and carefully considering variables such as cash flows, discount rate, time horizon, sensitivity analysis, risk assessment, and opportunity cost, stakeholders can conduct comprehensive NPV analyses. This enables informed investment decisions, effective allocation of resources, and the maximization of value creation. NPV analysis, coupled with a deep understanding of these variables, empowers businesses to make strategic investments and achieve sustainable growth in today's dynamic and competitive market landscape.

3 Responses