Introduction:

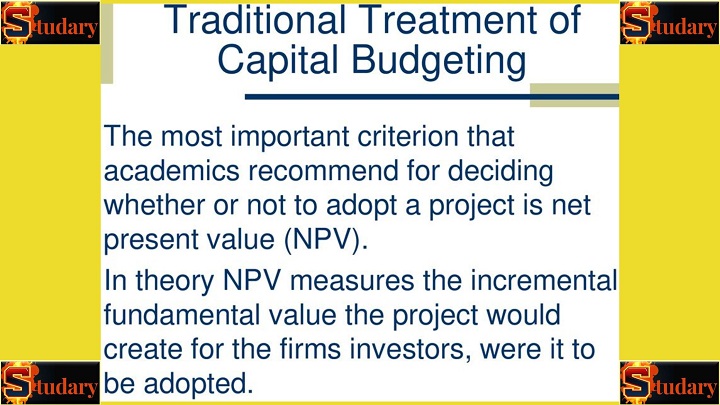

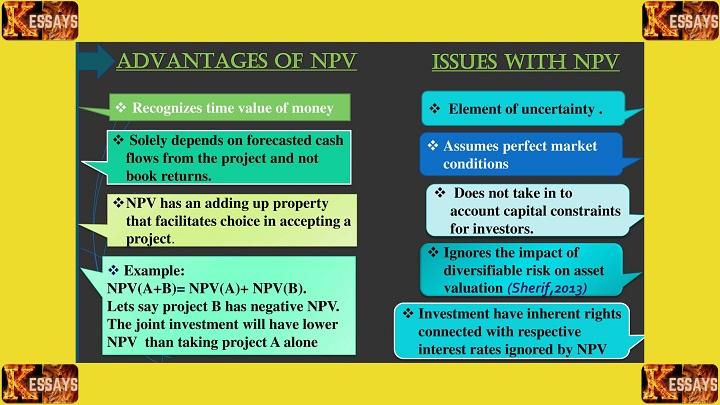

Behavioral biases refer to cognitive and emotional tendencies that lead individuals to deviate from rational decision-making processes. These biases can significantly impact capital budgeting decisions, where organizations assess investment opportunities for long-term value creation. Understanding the role of behavioral biases in capital budgeting is crucial, as it allows decision-makers to recognize and mitigate potential pitfalls that could hinder effective resource allocation and hinder organizational success.

-

Behavioral Biases and Capital Budgeting Decisions:

In the context of capital budgeting, behavioral biases influence how individuals perceive and evaluate investment projects. These biases stem from heuristics, mental shortcuts, and emotional responses, leading to deviations from optimal decision-making.

- Heuristics: Behavioral biases in capital budgeting are often influenced by cognitive shortcuts or heuristics that individuals use to simplify complex decision-making processes. These mental shortcuts can lead to oversimplification and may not consider all relevant information, affecting the accuracy of investment evaluations.

- Mental Shortcuts: Decision-makers may rely on mental shortcuts, such as availability heuristic (relying on readily available information) or representativeness heuristic (making judgments based on similarity to a known prototype), which can lead to biased assessments of investment opportunities.

- Emotional Responses: Emotional responses play a significant role in capital budgeting decisions. Fear, excitement, and overconfidence can cloud judgment, leading to impulsive choices and suboptimal investment decisions.

- Prospect Theory: Prospect theory, a prominent behavioral economics concept, suggests that individuals are more sensitive to potential losses than gains. This asymmetric risk perception can influence capital budgeting decisions, making decision-makers overly risk-averse or risk-seeking.

- Ambiguity Aversion: Behavioral biases like ambiguity aversion can lead decision-makers to prefer familiar investment options over unknown or uncertain ones, even if the latter may have higher potential returns.

- Anchoring and Adjustment: The anchoring bias can influence capital budgeting decisions by fixating decision-makers on specific initial pieces of information, which may act as reference points, leading to biased judgments and estimates.

- Cognitive Dissonance: Cognitive dissonance can arise when decision-makers experience discomfort from holding conflicting beliefs or making challenging choices. To reduce dissonance, individuals may rationalize investment decisions that are not objectively sound.

- Loss Aversion: Behavioral biases like loss aversion can cause decision-makers to be overly cautious when faced with potential losses, leading to a reluctance to take necessary risks that could lead to substantial gains.

- Herding Behavior: In capital budgeting, herding behavior can occur when decision-makers follow the investment choices of others without conducting independent evaluations. This can lead to a lack of diversification and potential missed opportunities.

- Status Quo Bias: The status quo bias can hinder the exploration of new investment opportunities. Decision-makers may prefer to maintain the current portfolio rather than consider alternative investments, even if they may be more profitable.

- Overconfidence: Overconfidence bias can lead decision-makers to overestimate their abilities to predict future outcomes or assess investment risks accurately. This may lead to excessive risk-taking and unwarranted confidence in suboptimal investment choices.

- Framing Effect: The framing effect can influence how investment opportunities are presented to decision-makers, impacting their perceptions and judgments. Different framing of the same investment option can lead to varying investment decisions.

- Endowment Effect: The endowment effect can cause decision-makers to place a higher value on assets they already possess, leading to biased assessments of the worth of existing investments.

- Confirmation Bias: Confirmation bias can influence capital budgeting decisions by causing individuals to seek and interpret information that confirms their pre-existing beliefs or opinions about specific investment opportunities.

Recognizing these behavioral biases and their potential impact on capital budgeting decisions is crucial for decision-makers to adopt strategies to mitigate their influence and make more informed and rational investment choices. By understanding these biases, organizations can implement measures to improve decision-making processes and optimize resource allocation for long-term success.

-

Overconfidence Bias:

One prevalent behavioral bias in capital budgeting is overconfidence. Decision-makers may overestimate their abilities and the prospects of a project, leading them to take on riskier investments without adequate analysis.

Anchoring Bias:

The anchoring bias is another behavioral bias that can significantly impact capital budgeting decisions. Decision-makers may fixate on initial information or reference points when evaluating investment opportunities, and this anchoring can distort their judgment and lead to biased assessments of potential projects.

Confirmation Bias:

Confirmation bias occurs when decision-makers seek and interpret information in a way that confirms their pre-existing beliefs or opinions about specific investment opportunities. In capital budgeting, this bias can lead to a selective focus on data that supports their initial inclinations, potentially overlooking critical information that might challenge their decisions.

Endowment Effect:

The endowment effect is a behavioral bias in which individuals place a higher value on assets they already possess compared to identical assets they do not own. In capital budgeting, this can lead to a reluctance to divest from current projects or assets, even if better investment opportunities exist.

Loss Aversion:

Loss aversion is a behavioral bias where individuals feel the pain of potential losses more intensely than the pleasure of equivalent gains. In capital budgeting, this can make decision-makers overly risk-averse, avoiding potentially lucrative projects to minimize the fear of losses.

Sunk Cost Fallacy:

The sunk cost fallacy occurs when decision-makers consider unrecoverable costs invested in a project when making current investment decisions. This bias can lead to irrational behavior, where past expenditures influence choices rather than the project's future potential.

Groupthink:

Groupthink is a behavioral bias that can occur in the context of capital budgeting when decision-makers prioritize consensus and conformity over independent critical thinking. This can lead to a lack of diverse perspectives and hinder the exploration of alternative investment options.

Hindsight Bias:

Hindsight bias is the tendency for decision-makers to believe that they had accurately predicted an event's outcome after it has occurred. In capital budgeting, this bias can lead to unwarranted certainty in past investment decisions, potentially influencing future choices.

Availability Bias:

The availability bias occurs when decision-makers rely on readily available information rather than conducting a comprehensive analysis. In capital budgeting, this bias can lead to hasty judgments based on easily accessible data, overlooking crucial factors that might impact investment outcomes.

Representativeness Bias:

The representativeness bias is a cognitive bias where decision-makers make judgments based on similarities between investment opportunities and known prototypes, rather than conducting a thorough assessment of the project's unique characteristics.

Recency Bias:

Recency bias is the tendency for decision-makers to give more weight to recent events or information when making investment decisions. This bias can lead to short-term thinking and overlooking long-term implications of investment choices.

Emotional Bias:

Emotional biases, such as fear, excitement, or anxiety, can significantly impact capital budgeting decisions. Emotional responses to investments can cloud judgment and lead to impulsive decision-making, potentially compromising the overall investment strategy.

Awareness of these behavioral biases is crucial for decision-makers involved in capital budgeting. By recognizing these biases and implementing strategies to counter their effects, organizations can enhance their decision-making processes and make more rational and profitable investment choices. Additionally, promoting a culture of open communication and diverse perspectives can help mitigate the influence of biases and foster a more objective approach to capital budgeting.

-

Confirmation Bias:

Confirmation bias occurs when individuals seek information that confirms their pre-existing beliefs or preferences regarding a particular investment opportunity. This can lead to a narrow assessment of alternatives and hinder unbiased decision-making.

Endowment Effect:

The endowment effect is a behavioral bias in which individuals place a higher value on assets they already possess compared to identical assets they do not own. In capital budgeting, this bias can lead to a reluctance to divest from current projects or assets, even if better investment opportunities exist.

Loss Aversion:

Loss aversion is a behavioral bias where individuals feel the pain of potential losses more intensely than the pleasure of equivalent gains. In capital budgeting, this can make decision-makers overly risk-averse, avoiding potentially lucrative projects to minimize the fear of losses.

Sunk Cost Fallacy:

The sunk cost fallacy occurs when decision-makers consider unrecoverable costs invested in a project when making current investment decisions. This bias can lead to irrational behavior, where past expenditures influence choices rather than the project's future potential.

Groupthink:

Groupthink is a behavioral bias that can occur in the context of capital budgeting when decision-makers prioritize consensus and conformity over independent critical thinking. This can lead to a lack of diverse perspectives and hinder the exploration of alternative investment options.

Hindsight Bias:

Hindsight bias is the tendency for decision-makers to believe that they had accurately predicted an event's outcome after it has occurred. In capital budgeting, this bias can lead to unwarranted certainty in past investment decisions, potentially influencing future choices.

Availability Bias:

The availability bias occurs when decision-makers rely on readily available information rather than conducting a comprehensive analysis. In capital budgeting, this bias can lead to hasty judgments based on easily accessible data, overlooking crucial factors that might impact investment outcomes.

Representativeness Bias:

The representativeness bias is a cognitive bias where decision-makers make judgments based on similarities between investment opportunities and known prototypes, rather than conducting a thorough assessment of the project's unique characteristics.

Recency Bias:

Recency bias is the tendency for decision-makers to give more weight to recent events or information when making investment decisions. This bias can lead to short-term thinking and overlooking long-term implications of investment choices.

Emotional Bias:

Emotional biases, such as fear, excitement, or anxiety, can significantly impact capital budgeting decisions. Emotional responses to investments can cloud judgment and lead to impulsive decision-making, potentially compromising the overall investment strategy.

Awareness of these behavioral biases is crucial for decision-makers involved in capital budgeting. By recognizing these biases and implementing strategies to counter their effects, organizations can enhance their decision-making processes and make more rational and profitable investment choices. Additionally, promoting a culture of open communication and diverse perspectives can help mitigate the influence of biases and foster a more objective approach to capital budgeting.

-

Anchoring Bias:

Anchoring bias involves fixating on a specific piece of information, such as historical performance, while neglecting other relevant factors during the evaluation process. This can lead to distorted perceptions of investment opportunities.

Framing Bias:

Framing bias occurs when the way information is presented or framed influences decision-making. In capital budgeting, how investment opportunities are presented can impact how decision-makers perceive the risk and potential returns associated with the projects.

Herding Behavior:

Herding behavior is a behavioral bias in which individuals tend to follow the crowd or the actions of others, rather than making independent decisions. This can lead to a lack of diversity in investment choices and the potential for overlooking unique and profitable opportunities.

Overconfidence in Forecasting:

Overconfidence in forecasting is a bias where decision-makers have excessive faith in their ability to predict future outcomes accurately. This can lead to overly optimistic projections and underestimating potential risks in capital budgeting decisions.

Status Quo Bias:

The status quo bias refers to the preference for maintaining the current state of affairs rather than making changes or pursuing new investment opportunities. This bias can result in a reluctance to explore innovative projects or reallocate resources to optimize returns.

Regret Aversion:

Regret aversion is a behavioral bias where decision-makers avoid making choices that might lead to regret, even if those choices are financially sound. In capital budgeting, this can result in avoiding potentially rewarding investments due to fear of making a wrong decision.

Anchoring to Past Budgets:

Anchoring to past budgets is a bias in which previous budgetary figures influence the current capital budgeting decisions. Decision-makers may be hesitant to deviate from historical spending patterns, even if there are more profitable alternatives available.

Biases in Risk Assessment:

Behavioral biases can also influence how decision-makers assess risk in investment opportunities. For example, the fear of uncertainty may lead to underestimating the potential risks associated with a project, impacting its overall evaluation.

Mitigating Behavioral Biases:

Recognizing and mitigating behavioral biases in capital budgeting is vital for making sound investment decisions. Strategies to address these biases include:

- Raising Awareness: Educating decision-makers about the existence and impact of behavioral biases can help them become more conscious of their potential influence.

- Utilizing Decision Tools: Implementing decision-making tools and frameworks that consider multiple factors can help mitigate the influence of individual biases.

- Diverse Decision-Making Teams: Encouraging diverse perspectives and collaboration among decision-makers can lead to more objective and well-rounded evaluations.

- Deliberate Reflection: Encouraging decision-makers to take time for reflection and evaluation before finalizing investment decisions can help counter impulsive and emotional biases.

- Independent Review: Seeking external or independent opinions on investment proposals can provide a fresh perspective and help avoid groupthink.

In conclusion, understanding and addressing behavioral biases in capital budgeting are essential for making rational and profitable investment decisions. By incorporating these strategies, organizations can enhance their decision-making processes and optimize their resource allocation for long-term financial success.

-

Sunk Cost Fallacy:

The sunk cost fallacy occurs when decision-makers continue to invest in a project based on the resources already committed, even when objective assessments indicate that the project is no longer viable.

Narrow Framing:

Narrow framing bias involves focusing on individual investment decisions in isolation, without considering their cumulative impact on the overall portfolio. This can lead to suboptimal resource allocation and missed opportunities for diversification.

Emotional Biases:

Emotional biases, such as fear or greed, can significantly impact capital budgeting decisions. Fear may lead to avoiding potentially profitable but uncertain investments, while greed may result in taking on excessive risks without adequate analysis.

Overemphasis on Recent Events:

Decision-makers may give undue weight to recent events or short-term performance when evaluating investment opportunities. This bias can lead to overlooking the long-term prospects and sustainability of projects.

Recency Bias:

Recency bias refers to the tendency to rely heavily on the most recent information available, even if historical data suggests a different pattern. This can lead to neglecting past trends and making decisions based on recent, potentially temporary, market conditions.

Groupthink:

Groupthink occurs when decision-makers prioritize consensus and harmony over critical evaluation of investment opportunities. This can hinder constructive debates and limit the consideration of alternative viewpoints.

Loss Aversion:

Loss aversion bias is the tendency to strongly prefer avoiding losses over acquiring equivalent gains. Decision-makers may be overly cautious when faced with potential losses, leading to missed opportunities for higher returns.

Confirmation Bias:

Confirmation bias in capital budgeting involves seeking information that confirms pre-existing beliefs about an investment, while disregarding evidence that contradicts those beliefs. This can lead to biased assessments of projects.

Overcoming Behavioral Biases:

To mitigate behavioral biases in capital budgeting decisions, companies can implement the following strategies:

- Rigorous Analysis: Encourage thorough and unbiased analysis of investment opportunities, considering both quantitative and qualitative factors.

- Diverse Perspectives: Foster an environment that encourages diverse perspectives and open discussions to challenge conventional thinking.

- Decision-Making Guidelines: Establish clear decision-making guidelines and criteria for evaluating projects to avoid undue influence from biases.

- External Expertise: Seek input from external experts or consultants to provide an objective assessment of investment proposals.

- Long-Term Focus: Emphasize the long-term objectives and sustainability of projects, rather than being swayed by short-term market fluctuations.

- Continuous Learning: Promote continuous learning and self-awareness among decision-makers to recognize and address behavioral biases.

By acknowledging and addressing behavioral biases in capital budgeting, businesses can make more rational, informed, and successful investment decisions that align with their overall financial goals. Combining objective analysis with an understanding of human psychology can lead to better resource allocation, improved risk management, and enhanced long-term profitability.

-

Framing Effect:

The framing effect occurs when the presentation of information influences decision-making. Decision-makers may react differently to the same investment opportunity based on how it is framed, affecting their ultimate choice.

Status Quo Bias:

The status quo bias refers to the tendency to prefer maintaining the current situation or making minimal changes, even when alternative options may offer better outcomes. Decision-makers may resist adopting new investment projects due to a comfort with the existing state.

Herd Mentality:

Herd mentality bias involves following the crowd and making investment decisions based on what others are doing, rather than conducting independent analysis. This can lead to a lack of diversity in investment portfolios and increased vulnerability to market trends.

Anchoring and Adjustment:

Anchoring and adjustment bias occurs when decision-makers fixate on initial information (anchor) and make adjustments from that point, rather than starting from scratch. This can lead to biased estimates and misjudgments of investment opportunities.

Overcoming Behavioral Biases:

To address behavioral biases in capital budgeting decisions, organizations can implement various strategies:

- Awareness and Education: Raise awareness about different biases among decision-makers and provide training to recognize and counteract their influence.

- Diverse Decision-Making Teams: Form diverse teams with individuals from different backgrounds and expertise to bring varied perspectives and challenge biases.

- Structured Decision-Making Process: Implement a structured decision-making process that includes objective criteria and evaluates investment opportunities based on their merits.

- Independent Review: Encourage independent review and analysis of investment proposals by individuals not directly involved in the decision-making process.

- Benchmarking: Use benchmarking and industry comparisons to gain objective insights into investment opportunities and avoid undue reliance on internal assessments.

- Stress Testing: Conduct stress testing and scenario analyses to assess the resilience of investment projects under different market conditions.

By adopting these strategies and fostering a culture of rational decision-making, businesses can mitigate the impact of behavioral biases on capital budgeting decisions. Emphasizing data-driven analysis, long-term goals, and a commitment to sound financial principles can lead to more robust investment choices and improved overall financial performance.

-

Herding Behavior:

Herding behavior refers to the tendency of decision-makers to follow the actions of others rather than independently evaluating investment opportunities. This can lead to a lack of diversification in the organization's portfolio.

Regret Aversion:

Regret aversion bias occurs when decision-makers avoid taking actions that might lead to regret in the future, even if those actions are financially rational. This bias can lead to a reluctance to cut losses on underperforming investments or a fear of missing out on potential gains.

Availability Bias:

The availability bias involves relying on readily available information or recent events when making decisions, rather than considering the full range of relevant data. This bias can lead to overlooking important factors and making suboptimal investment choices.

Overcoming Behavioral Biases in Capital Budgeting:

To mitigate the impact of behavioral biases in capital budgeting decisions, organizations can implement several strategies:

- Training and Education: Provide training to decision-makers on behavioral biases and their potential impact on investment decisions. Increasing awareness can help individuals recognize and challenge their biases.

- Utilize Decision Tools: Implement decision tools and models that encourage systematic and data-driven evaluations of investment projects, reducing the influence of biases.

- Diverse Perspectives: Encourage input from a diverse group of decision-makers with varying expertise and backgrounds to foster objective evaluations.

- Independent Evaluation: Seek independent evaluations of investment proposals from individuals not directly involved in the decision-making process to ensure unbiased assessments.

- Long-Term Orientation: Emphasize long-term goals and objectives in capital budgeting decisions to reduce the impact of short-term biases.

- Post-Investment Reviews: Conduct regular post-investment reviews to assess the performance of previous investments objectively and learn from past decisions.

- Encourage Dissent: Create an environment where dissenting opinions are valued and encouraged, allowing for robust discussions and challenging of prevailing assumptions.

By incorporating these strategies, organizations can promote a more rational and objective approach to capital budgeting decisions, ultimately leading to better investment choices and improved financial outcomes. It is essential to recognize that while behavioral biases are inherent in human decision-making, proactive efforts can minimize their influence and enhance the overall effectiveness of the capital budgeting process.

-

Status Quo Bias:

The status quo bias occurs when decision-makers prefer to maintain the current course of action rather than exploring new investment opportunities, even when change may be beneficial.

Anchoring and Adjustment:

Anchoring and adjustment bias involves decision-makers relying too heavily on initial information, or "anchors," when making investment decisions, leading to insufficient adjustments for new data or changing circumstances.

Loss Aversion:

Loss aversion bias refers to the tendency of decision-makers to strongly prefer avoiding losses over acquiring gains. As a result, they may be overly cautious in making investment decisions, even if the potential gains outweigh the potential losses.

Overcoming Behavioral Biases in Capital Budgeting:

To overcome behavioral biases in capital budgeting, organizations can adopt the following strategies:

- Decision-Making Committees: Establish decision-making committees that include members with diverse expertise, perspectives, and backgrounds to challenge each other's biases and arrive at more balanced decisions.

- Structured Decision Frameworks: Implement structured decision frameworks that require a systematic evaluation of investment opportunities, reducing the influence of emotional and biased judgments.

- Data Analytics: Utilize data analytics and advanced technology to analyze investment data objectively and make evidence-based decisions, minimizing the impact of subjective biases.

- Scenario Analysis: Conduct scenario analyses to assess investment opportunities under various potential outcomes, helping decision-makers better understand risk and uncertainty.

- Professional Advice: Seek advice from financial experts and external consultants who can provide an impartial and objective assessment of investment proposals.

- Behavioral Training: Provide behavioral training to decision-makers, enabling them to recognize and manage their biases effectively.

- Regular Review: Regularly review past investment decisions to identify instances where biases may have influenced outcomes and learn from those experiences.

By incorporating these strategies into the capital budgeting process, organizations can foster a more rational and evidence-based approach to investment decision-making. While behavioral biases are an inherent part of human nature, proactive efforts to recognize, understand, and address them can lead to better investment outcomes and overall financial success.

-

Endowment Effect:

The endowment effect occurs when individuals place a higher value on assets they already possess compared to the value they would place on acquiring the same assets.

Framing Effect:

The framing effect occurs when the presentation of information influences decision-making. Decision-makers may react differently to the same investment opportunity based on how it is framed, affecting their ultimate choice.

Herding Behavior:

Herding behavior refers to the tendency of decision-makers to follow the actions of others rather than independently evaluating investment opportunities. This can lead to a lack of diversification in the organization's portfolio.

Status Quo Bias:

The status quo bias occurs when decision-makers prefer to maintain the current course of action rather than exploring new investment opportunities, even when change may be beneficial.

Anchoring and Adjustment:

Anchoring and adjustment bias involves decision-makers relying too heavily on initial information, or "anchors," when making investment decisions, leading to insufficient adjustments for new data or changing circumstances.

Loss Aversion:

Loss aversion bias refers to the tendency of decision-makers to strongly prefer avoiding losses over acquiring gains. As a result, they may be overly cautious in making investment decisions, even if the potential gains outweigh the potential losses.

Overcoming Behavioral Biases in Capital Budgeting:

To overcome behavioral biases in capital budgeting, organizations can adopt the following strategies:

- Decision-Making Committees: Establish decision-making committees that include members with diverse expertise, perspectives, and backgrounds to challenge each other's biases and arrive at more balanced decisions.

- Structured Decision Frameworks: Implement structured decision frameworks that require a systematic evaluation of investment opportunities, reducing the influence of emotional and biased judgments.

- Data Analytics: Utilize data analytics and advanced technology to analyze investment data objectively and make evidence-based decisions, minimizing the impact of subjective biases.

- Scenario Analysis: Conduct scenario analyses to assess investment opportunities under various potential outcomes, helping decision-makers better understand risk and uncertainty.

- Professional Advice: Seek advice from financial experts and external consultants who can provide an impartial and objective assessment of investment proposals.

- Behavioral Training: Provide behavioral training to decision-makers, enabling them to recognize and manage their biases effectively.

- Regular Review: Regularly review past investment decisions to identify instances where biases may have influenced outcomes and learn from those experiences.

By incorporating these strategies into the capital budgeting process, organizations can foster a more rational and evidence-based approach to investment decision-making. While behavioral biases are an inherent part of human nature, proactive efforts to recognize, understand, and address them can lead to better investment outcomes and overall financial success. The Role of Behavioral Biases in Capital Budgeting is a crucial aspect that organizations must acknowledge and manage to make informed and prudent investment decisions for sustainable growth and profitability.

-

Prospect Theory:

Prospect theory posits that individuals perceive gains and losses differently, with losses having a more significant impact on decision-making than equivalent gains. This can lead to risk-averse behavior in capital budgeting.

Endowment Effect:

The endowment effect occurs when individuals place a higher value on assets they already possess compared to the value they would place on acquiring the same assets. In capital budgeting, this bias can lead decision-makers to overvalue current investments, making it challenging for them to divest from underperforming projects or assets.

Regret Aversion:

Regret aversion bias is the tendency to avoid making decisions that may lead to regret, even if those decisions offer better potential outcomes. In capital budgeting, decision-makers may avoid taking risks, even if there is a higher chance of achieving substantial returns, to avoid the potential regret of making a wrong decision.

Mental Accounting:

Mental accounting refers to the practice of segregating financial resources into different mental accounts based on their origin or intended use. In capital budgeting, this bias can lead decision-makers to allocate funds based on the source of the funds rather than the overall financial objectives, resulting in suboptimal investment decisions.

Confirmation Bias:

Confirmation bias occurs when individuals seek information that confirms their pre-existing beliefs or preferences regarding a particular investment opportunity. This can lead to a narrow assessment of alternatives and hinder unbiased decision-making.

Availability Heuristic:

The availability heuristic bias involves decision-makers relying on readily available information or examples when making decisions. In capital budgeting, this can lead to the preference of familiar investment opportunities, overlooking potentially more lucrative options that require deeper analysis.

Overcoming Behavioral Biases in Capital Budgeting:

To overcome behavioral biases in capital budgeting, organizations can adopt the following strategies:

- Diverse Decision-Making Teams: Form decision-making teams with diverse backgrounds and perspectives to challenge biases and encourage open discussions during the evaluation process.

- Robust Data Analysis: Utilize comprehensive data analysis and financial models to objectively assess investment opportunities and quantify potential risks and rewards.

- Decision-Making Frameworks: Implement structured decision-making frameworks that require a thorough evaluation of investment proposals based on objective criteria and financial metrics.

- Scenario Planning: Utilize scenario planning and sensitivity analysis to assess how investments may perform under different market conditions, helping to mitigate the impact of biases.

- Avoiding Emotional Triggers: Recognize emotional triggers that may lead to biased decision-making and create a decision-making environment that encourages rational and logical analysis.

- Review Past Decisions: Regularly review past investment decisions to identify instances where biases may have influenced outcomes and learn from those experiences.

- External Expertise: Seek input from external financial experts or consultants to provide an impartial evaluation of investment proposals.

By incorporating these strategies, organizations can minimize the influence of behavioral biases in capital budgeting and make more objective and informed investment decisions. Understanding and managing behavioral biases is crucial for successful capital budgeting, as it ensures that investment choices align with the organization's financial goals and lead to sustainable growth and profitability. The Role of Behavioral Biases in Capital Budgeting requires continuous awareness and efforts to foster a rational and evidence-based decision-making process.

Impact of Behavioral Biases on Capital Budgeting:

Behavioral biases can have significant consequences for capital budgeting decisions. These biases may lead to suboptimal resource allocation, underinvestment in potentially lucrative projects, and an imbalanced risk profile in the investment portfolio.

-

Distorted Risk Assessment:

Behavioral biases can distort risk assessment, leading to either excessive risk-taking or excessive risk aversion. Decision-makers may overlook potential risks or underestimate the likelihood of negative outcomes, resulting in poor investment choices.

-

Reduced Diversification:

Herding behavior and status quo bias may lead to reduced diversification in the investment portfolio. Overemphasis on familiar assets or following the actions of others can limit exposure to new opportunities and potentially hinder overall returns.

-

Ignoring Relevant Information:

Confirmation bias and anchoring bias can cause decision-makers to ignore relevant information that contradicts their initial beliefs or perceptions. This narrow focus may lead to missed opportunities and poor investment decisions.

-

Delayed Decision-Making:

The sunk cost fallacy can lead to delayed decision-making as decision-makers may be reluctant to abandon projects they have already invested resources in, even if continuing the project is not financially viable.

Mitigating Behavioral Biases in Capital Budgeting:

Recognizing and mitigating behavioral biases is crucial for improving the effectiveness of capital budgeting decisions.

-

Awareness and Training:

Raising awareness of behavioral biases and providing training can help decision-makers recognize when these biases may be influencing their judgment.

-

Objective Evaluation:

Encouraging decision-makers to conduct objective evaluations and challenge their assumptions can help counter confirmation bias and anchoring bias.

-

Diverse Perspectives:

Seeking input from diverse perspectives can help reduce the impact of herding behavior and groupthink in decision-making.

-

Data-Driven Analysis:

Using data-driven analysis and metrics can help decision-makers make more rational and informed investment choices.

Conclusion:

Behavioral biases in capital budgeting can significantly impact investment decisions, leading to suboptimal resource allocation and reduced returns. By understanding these biases and implementing strategies to mitigate their influence, organizations can make more rational and effective capital budgeting decisions, driving long-term value creation and success. Recognizing the role of behavioral biases in capital budgeting is essential for building a resilient and adaptive investment strategy that aligns with the organization's strategic objectives.