Introduction

In the intricate landscape of financial modeling, one concept holds significant importance: the

Role of Terminal Value. Financial models, especially those employed in Discounted Cash Flow (DCF) analysis, often incorporate terminal value to capture the long-term value of an investment beyond the projection horizon. Terminal value plays a crucial role in ensuring the completeness and accuracy of financial evaluations, guiding decision-makers in making informed choices. This essay delves into the essence of terminal value, its formulas, calculators, practical examples, and its significance in financial modeling.

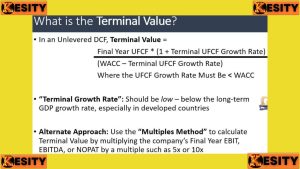

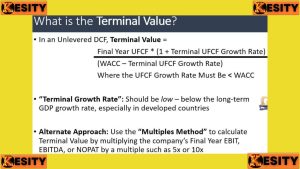

Terminal Value Formula: Ensuring Long-Term Accuracy

The terminal value formula is an integral component of financial modeling, providing a mechanism to account for a project's value beyond the explicit forecast period. Typically, there are two widely used methods to calculate terminal value: the

Gordon Growth Model (also known as the perpetuity growth model) and the

Exit Multiple Method.

The

Gordon Growth Model terminal value formula estimates the value of a company or investment at a future point in time assuming it grows at a constant rate indefinitely. The formula for the Gordon Growth Model is:

Terminal Value = Final Year Cash Flow × (1 + g) / (r - g)

Where:

- Final Year Cash Flow is the expected cash flow in the last projected year.

- g is the constant growth rate of cash flows.

- r is the discount rate.

The

Exit Multiple Method, on the other hand, uses a selected multiple (such as EBITDA or Earnings) applied to a future year's projected financial metric to calculate the terminal value. This method captures the assumption that the company will be sold or valued based on industry standards.

Key Aspects of the Role of Terminal Value:

- Long-Term Perspective: Terminal value extends financial analysis beyond the explicit forecast period, providing insight into an investment's long-term potential.

- Accurate Valuation: It ensures a more accurate valuation by accounting for future cash flows that might unfold beyond the forecast horizon.

- Overcoming Forecast Limitations: Terminal value addresses the limitations of finite forecast periods, capturing an investment's true value that may not be fully represented within the forecast years.

- Comparative Analysis: It allows for meaningful comparisons among diverse investments with varying growth patterns, enabling informed decision-making.

- Dynamic Business Context: Terminal value recognizes the dynamic nature of business, reflecting the changing economic conditions, technological advancements, and market trends.

- Strategic Alignment: By guiding strategic decision-making, terminal value aids in aligning investments with long-term organizational goals.

- Risk Assessment: It enhances risk assessment by considering various scenarios' impacts on terminal value, enabling robust risk management strategies.

- Time Value of Money: Terminal value incorporates the time value of money by discounting future values back to the present, accounting for inflation and preference for present consumption.

- Flexibility with Growth Trajectories: Terminal value accommodates varying growth trajectories, from rapid expansion to gradual maturation, in its valuation approach.

- Completeness in Analysis: Including terminal value ensures that financial analysis captures an investment's complete worth, bridging the gap between finite forecasts and the indefinite nature of business.

- Strategic Resource Allocation: It aids in allocating resources strategically by offering insights into an investment's enduring potential and impact on the organization.

- Foundation of DCF Analysis: Terminal value is a fundamental component of Discounted Cash Flow (DCF) analysis, providing a substantial portion of an investment's overall value.

- Perpetuity Consideration: Terminal value accounts for the perpetuity of cash flows or business value beyond the initial projection period.

- Guidance in Investment Decisions: By presenting a more comprehensive evaluation, terminal value guides investment decisions that align with the organization's long-term objectives.

- Incorporating Business Uncertainties: It acknowledges the inherent uncertainty and volatility of the business environment, enabling a more realistic evaluation of an investment's potential.

- Holistic Understanding: Terminal value ensures decision-makers have a holistic understanding of an investment's trajectory, assisting them in making well-informed choices.

- Accounting for Exit Strategies: Terminal value is especially relevant when considering exit strategies, as it reflects the value an investment brings even beyond the point of exit.

- Sensitivity Analysis: Terminal value contributes to sensitivity analysis by assessing the impacts of varying growth rates on an investment's value.

- Industry Benchmarking: It facilitates industry benchmarking by incorporating the application of exit multiples to projected financial metrics.

- Preserving Investment Continuity: Terminal value emphasizes the importance of long-term continuity in investment evaluations, aligning analysis with the dynamic nature of businesses.

Terminal Value Calculator: Streamlining Complex Evaluations

The complexity of terminal value calculations is often streamlined by terminal value calculators. These tools, available in various financial software and spreadsheets, automate the application of terminal value formulas, reducing the chances of computational errors and improving efficiency in financial modeling.

Terminal Value Example: Putting Theory into Practice

Consider a scenario where a company's projected cash flows extend for a period of five years, after which a steady growth rate of 3% is assumed. If the discount rate is 10%, the terminal value can be calculated using the Gordon Growth Model as shown above. This value is then discounted back to the present using the discount rate, providing an estimate of the investment's perpetuity value.

PV of Terminal Value Formula: Present Value of Long-Term Potential

The concept of

present value of terminal value integrates the terminal value's significance into a comprehensive financial model. This involves discounting the terminal value back to the present day to account for the time value of money, aiding in accurate valuation.

Benefits of Terminal Value: Enriching Financial Analysis

The role of terminal value extends far beyond the mere extension of forecasts. It plays a pivotal role in enriching financial analysis by offering a range of advantages that enhance the accuracy and comprehensiveness of investment evaluations. These benefits contribute to a more holistic understanding of an investment's true value and its potential impact on the organization's financial landscape.

1. Providing a More Accurate Valuation

Terminal value ensures that the evaluation of an investment incorporates its long-term potential. By capturing the projected cash flows beyond the explicit forecast period, terminal value offers a more complete picture of the investment's enduring worth. This accuracy is especially critical in scenarios where the value of a project unfolds gradually over time, beyond the initial forecast years.

2. Addressing the Limitation of Finite Forecast Periods

Inherent to financial modeling are the constraints of finite forecast periods. These limitations might not capture the full spectrum of a project's value, particularly when an investment's impact extends well beyond the foreseeable future. Terminal value rectifies this limitation by accounting for the continuing value the project generates beyond the explicit forecast horizon.

3. Allowing for Comparisons of Diverse Investments

Investments come in various shapes and sizes, each with its unique growth patterns, lifecycles, and industry characteristics. Terminal value enables meaningful comparisons across these diverse investments. By considering the long-term value generated by each investment, regardless of their distinct temporal profiles, decision-makers gain a robust framework to assess opportunities on a more level playing field.

4. Reflecting the Dynamic Nature of Business

Business environments are dynamic, subject to fluctuations in economic conditions, technological advancements, and market trends. Terminal value captures the dynamic nature of business by recognizing that the value of an investment can evolve beyond the static confines of forecast years. This recognition aligns the financial analysis with the inherent uncertainty and volatility of the business landscape.

5. Guiding Strategic Decision-Making

Terminal value not only informs financial analysis but also contributes to strategic decision-making. By providing insights into an investment's enduring potential, it assists decision-makers in aligning investments with long-term organizational goals and strategies. This strategic alignment is crucial for sustainable growth and competitive advantage.

6. Enhancing Risk Assessment

A comprehensive understanding of an investment's long-term value aids in assessing and mitigating risks effectively. By considering the potential impacts of various scenarios on the terminal value, decision-makers can develop more robust risk management strategies, ensuring the resilience of their investments.

7. Recognizing Time Value of Money

The terminal value inherently acknowledges the time value of money, a fundamental concept in finance. By discounting the future terminal value back to the present, the analysis accounts for the impact of inflation and the preference for present consumption over future consumption.

8. Incorporating Varying Growth Trajectories

Different investments exhibit varying growth trajectories, from explosive growth to gradual maturation. Terminal value accommodates these diverse trajectories by capturing the long-term growth potential of each investment, irrespective of its short-term fluctuations.

Terminal Value in Stable Growth Model: A Staple of DCF Analysis

In a stable growth model, terminal value represents a substantial portion of a project's overall value. It encapsulates the value an investment contributes beyond the explicit forecast period, making it a foundational element of DCF analysis.

Terminal Values: Beyond the Horizon

Terminal values are essentially the future values of cash flows or the entire business that are projected beyond the explicit forecast horizon. They encapsulate the idea that investments have value beyond the foreseeable future, enabling a holistic perspective in financial decision-making.

Conclusion: The Culmination of Long-Term Worth

The role of terminal value in financial modeling is not merely a mathematical concept; it's a window into an investment's perpetual worth. Terminal value bridges the gap between finite forecasts and the indefinite nature of business, allowing decision-makers to make more informed choices based on a comprehensive understanding of an investment's complete trajectory. By integrating terminal value calculations into financial models, analysts and investors embrace the future, ensuring that their evaluations are not bound by short-term projections but rather encompass the full spectrum of an investment's potential.