Role of Profitability Index in Capital Budgeting

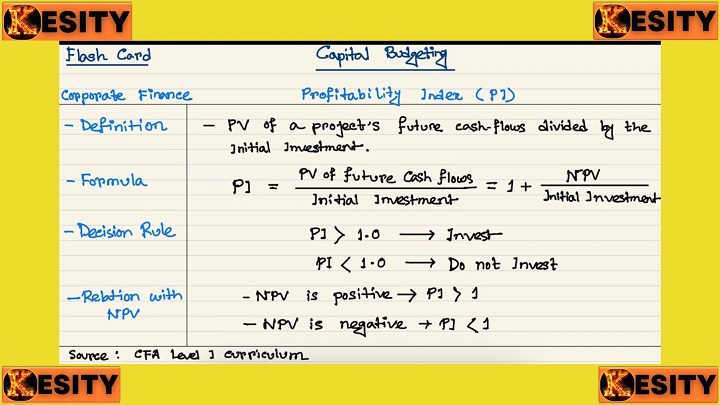

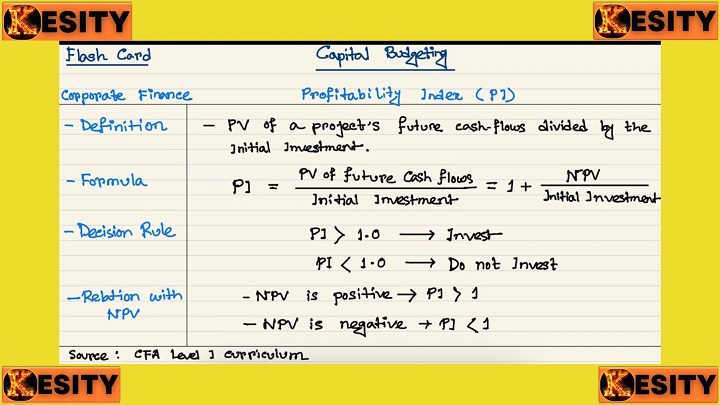

Capital budgeting, the process of evaluating and selecting investment projects that align with a company's long-term goals, is a critical endeavor for businesses seeking growth and profitability. Among the various tools and techniques available for this purpose, the

Role of Profitability Index (PI) stands out as a vital instrument that aids decision-makers in making informed choices about resource allocation and investment prioritization. This essay delves into the significance of the profitability index in capital budgeting, its relevance, how it aids in the

capital rationing process, its role as a capital budgeting tool, and its contribution to determining project feasibility.

- Capital Budgeting Essentials: In the domain of capital budgeting, where businesses meticulously assess and opt for investment projects aligning with their long-term ambitions, the significance of the Role of Profitability Index (PI) takes center stage.

- Driving Growth and Profitability: Capital budgeting is pivotal for companies aspiring to achieve not only growth but also sustained profitability, making it a critical endeavor that shapes their trajectory.

- Distinctive Tool in the Arsenal: Amidst a repertoire of tools and techniques available to facilitate capital budgeting decisions, the Role of Profitability Index (PI) emerges as a standout, facilitating insightful decisions for effective resource allocation and investment prioritization.

- Illuminating the Path: The profitability index acts as a guiding light within capital budgeting, offering a quantifiable metric to ascertain the potential profitability of investment ventures.

- Quantitative Assessment: By meticulously comparing the present value of expected cash inflows against cash outflows, the profitability index provides an objective and quantitative gauge of investment viability.

- Allocation Insight: The profitability index's relevance is underscored by its role in guiding allocation decisions, ensuring that resources are channeled to projects promising returns that outweigh costs.

- Capital Rationing Facilitator: The role of profitability index shines particularly in scenarios of capital rationing, where resources are scarce. It empowers decision-makers to judiciously distribute resources to projects with higher index values, maximizing returns within constraints.

- Uniform Evaluation Yardstick: Serving as a crucial capital budgeting tool, the profitability index offers a standardized mechanism for assessing diverse investment prospects regardless of their size or cash flow patterns.

- Streamlined Decision-Making: The role of profitability index as a tool streamlines the decision-making process by providing a common metric that simplifies the comparison of varying projects.

- Feasibility Determination: A distinct contribution of the profitability index is in gauging the feasibility of projects. An index exceeding 1 suggests potential profitability, while an index below 1 raises questions about returns justifying costs.

- Strategic Resource Management: The profitability index empowers organizations to align investments strategically with their long-term goals, fostering growth and profitability.

- Informed Resource Allocation: Through its role in capital budgeting, the profitability index ensures that resource allocation is informed, maximizing the utility of available resources.

- Decision Confidence: Decision-makers can have greater confidence in their investment choices with the profitability index offering a quantifiable measure of potential returns.

- Holistic Investment Perspective: The index's role contributes to a comprehensive understanding of investment potential beyond immediate forecasts.

- Objective Investment Analysis: The profitability index injects objectivity into investment analysis, mitigating biases and emotional factors.

- Guiding Long-Term Goals: Capital budgeting, aided by the profitability index, supports alignment with an organization's overarching strategic objectives.

- Enhanced Allocation Efficiency: The index enhances efficiency in allocating resources by focusing on projects with superior profitability potential.

- Facilitating Project Comparisons: The index acts as a bridge, allowing effective comparison of projects with varying sizes and cash flow profiles.

- Redefining Decision Paradigm: The profitability index redefines the decision-making paradigm, integrating quantitative evaluation with strategic insights.

- Future Sustainability: By aiding in determining project feasibility, the profitability index contributes to ensuring the sustainability of investments over time.

- Resource Maximization: The index's role in capital rationing assists in resource maximization, achieving optimal returns within budget constraints.

- Quantitative Precision: The profitability index offers a precise quantitative measure to gauge investment attractiveness and potential returns.

- Resource Allocation Precision: The role of profitability index facilitates precision in resource allocation, aligning with projects that generate value beyond costs.

- Steering Growth: The profitability index's role resonates as a steering mechanism, guiding investments toward growth and prosperity.

- Catalyst for Informed Decisions: The profitability index emerges as a catalyst, propelling decision-makers towards well-informed investment choices.

- Striking Balance: The role of profitability index finds harmony between immediate financial viability and long-term potential for investments.

Relevance of Profitability Index: A Measure of Investment Attractiveness

The profitability index serves as a pivotal measure of investment attractiveness within the capital budgeting framework. By comparing the present value of expected cash inflows to the present value of cash outflows, the profitability index provides a quantitative assessment of the potential profitability of an investment project. This relevance is underlined by its ability to offer a clear indicator of whether a project will generate more value than it consumes, guiding resource allocation decisions.

- Quantitative Evaluation: The profitability index assumes a central role in evaluating investment attractiveness within capital budgeting.

- Comparing Cash Flows: It assesses attractiveness by comparing the present value of expected cash inflows against cash outflows.

- Numerical Insight: The profitability index offers a numerical insight into the potential profitability of an investment project.

- Clear Indicator: Its significance lies in providing a clear indicator of whether a project will generate more value than it consumes.

- Guiding Resource Allocation: This ability to assess investment allure guides decision-makers in allocating resources strategically.

- Value-Centric Decision: The profitability index shifts the decision-making focus towards investments that yield surplus value.

- Quantifiable Comparison: It facilitates quantifiable comparisons among different investment projects.

- Evaluating Trade-offs: The index aids in evaluating trade-offs between inflows and outflows to ascertain overall profitability.

- Balancing Returns and Costs: Decision-makers can use the index to balance projected returns against incurred costs.

- Strategic Alignment: It aligns investments with organizational strategies by focusing on projects with positive value creation.

- Enhancing Investment Precision: The index enhances the precision of investment decisions, minimizing risks associated with ill-informed choices.

- Informed Resource Deployment: It ensures that resources are allocated to endeavors with promising potential.

- Aiding Decision Confidence: Decision-makers gain confidence in investing resources in projects with favorable index values.

- Factoring in Time Value: The index considers the time value of money, enhancing accuracy in evaluating long-term benefits.

- Overall Investment Viability: The index presents a comprehensive perspective on the overall viability of investment projects.

- Supporting Growth Objectives: By revealing attractive projects, it supports organizations in pursuing growth objectives.

- Facilitating Trade-off Analysis: The profitability index facilitates a systematic analysis of potential trade-offs in investment decisions.

- Unbiased Evaluation: The index provides an unbiased evaluation by quantifying investment attractiveness.

- Maximizing Returns: Decision-makers can utilize the index to maximize returns on investment endeavors.

- Resource Efficiency: It promotes resource efficiency by directing resources to high-value projects.

- Long-Term Impact: The index takes into account the long-term impact of investments on profitability.

- Objective Metric: It offers an objective metric to gauge the allure of investment opportunities.

- Strategic Resource Allocation: The index informs strategic allocation, supporting resource alignment with value generation.

- Better-Informed Decisions: Decision-makers make better-informed choices by relying on the index's insights.

Profitability Index and Capital Rationing: Making the Most of Limited Resources

Capital rationing involves allocating limited financial resources to a set of investment projects. The profitability index plays a crucial role in this process by ranking projects based on their relative attractiveness. When faced with budget constraints, decision-makers can prioritize projects with higher profitability index values, ensuring that the available resources are directed toward projects that promise the greatest return on investment.

- Capital Rationing Essence: Capital rationing denotes the allocation of restricted financial resources to a cluster of potential investment projects.

- Resource Limitation: This scenario arises due to finite financial resources available for investment endeavors.

- Resource Allocation Dilemma: Decision-makers are tasked with distributing limited funds among various competing projects.

- Profitability Index's Vital Role: The Role of Profitability Index (PI) assumes paramount significance in the context of capital rationing.

- Project Ranking Mechanism: The profitability index facilitates a systematic ranking of investment projects.

- Relative Attractiveness: Projects are evaluated based on their relative attractiveness, a pivotal factor in the allocation decision.

- Quantitative Comparison: The index enables a quantitative comparison among projects' potential returns and resource utilization.

- Maximizing Returns: Amidst budget constraints, decision-makers aspire to maximize returns within available limits.

- Prioritization Based on Index: Decision-makers employ the profitability index as a yardstick to prioritize projects.

- Strategic Resource Allocation: The index guides strategic allocation of limited resources.

- Favoring High PI Values: Projects with higher profitability index values are prioritized in allocation decisions.

- Return Optimization: The goal is to achieve optimal returns despite resource scarcity.

- Rationale of Choosing PI: Projects with superior index values are deemed to yield more value than consumed resources.

- Economic Efficiency: The index supports the efficient use of constrained financial resources.

- Value Generation: Allocation decisions revolve around projects that generate substantial value.

- Allocation Precision: Decision-makers employ the index for precise resource allocation.

- Striking Balance: The index helps in balancing project returns against resource commitments.

- Resource Diversion: Resources are diverted towards projects that promise greater potential for return on investment.

- Enhanced Decision Logic: The profitability index enriches decision-making logic through its quantitative insights.

- Avoiding Suboptimal Choices: The index aids in avoiding suboptimal allocation decisions.

- Resource Utilization Optimization: The index is instrumental in optimizing resource utilization.

- Strategic Asset Deployment: It facilitates the strategic deployment of limited financial assets.

- Value-Driven Investments: Allocation decisions are driven by the potential to create value.

- Rational Allocation: The index contributes to rationally allocating constrained resources.

- Return Magnification: High-index projects promise magnified returns relative to resource inputs.

- Resource Constraint Challenges: The profitability index addresses challenges posed by resource constraints.

- Outcome-Driven Decisions: Decision-makers focus on projects that offer promising outcomes.

- Resource Maximization: The profitability index contributes to maximizing resource utility and impact.

Profitability Index as a Capital Budgeting Tool: Enhancing Decision-Making

Indeed, the profitability index is a key player within the realm of capital budgeting. It allows decision-makers to objectively assess the profitability of various investment opportunities, regardless of their differing sizes or cash flow profiles. This standardized evaluation simplifies the decision-making process, aiding in comparing projects with diverse characteristics on a common metric.

- Capital Budgeting Facilitation: The Role of Profitability Index is pivotal in the realm of capital budgeting, streamlining decision-making processes.

- Objective Profitability Assessment: The index empowers decision-makers with an objective assessment of investment profitability.

- Uniform Metric: Regardless of the projects' diverse sizes or cash flow profiles, the index offers a uniform metric for comparison.

- Simplified Comparison: The index's standardized nature simplifies comparisons among investment opportunities.

- Size-agnostic Analysis: Decision-makers can evaluate projects of varying sizes on an equal footing.

- Quantitative Insights: The index provides quantitative insights into investment viability.

- Common Ground for Assessment: Different investment projects are brought onto a common ground for evaluation.

- Complexity Mitigation: The index mitigates complexity by providing a common evaluation platform.

- Streamlined Evaluation: It streamlines the evaluation process for different investment avenues.

- Apples-to-Apples Comparison: Decision-makers can conduct an apples-to-apples comparison.

- Project Diversity Consideration: Despite project diversity, the index ensures fair comparison.

- Objective Criteria: Decision-makers rely on objective criteria for investment assessment.

- Comparative Merit: The index facilitates a comparative assessment of project merit.

- Mitigating Bias: The index reduces bias by offering a standardized evaluation method.

- Risk Management: It contributes to risk management through comprehensive evaluation.

- Common Evaluation Yardstick: The index acts as a common yardstick for all investments.

- Diverse Cash Flow Patterns: It accommodates investments with diverse cash flow patterns.

- Informed Decision: Decision-makers make informed choices through the index's insights.

- Effective Resource Allocation: The index aids in allocating resources effectively.

- Balanced Analysis: Decision-makers can balance different investment prospects.

- Strategic Alignment: The index aligns investment choices with strategic goals.

- Fostering Objective Decisions: It fosters objective and well-informed decisions.

- Precision in Comparison: The index enables precise comparison of investment potential.

- Investment Opportunity Transparency: Decision-makers gain transparency into investment opportunities.

- Facilitating Trade-offs: The index aids in trade-off analysis among investments.

- Strategic Resource Allocation: It supports strategic allocation of resources for optimal results.

Determining Project Feasibility: Role of Profitability Index

The profitability index serves as a reliable tool for determining the feasibility of a project. When the index value is greater than 1, it signifies that the project's expected cash inflows outweigh the initial cash outflows, indicating a potentially profitable venture. On the other hand, a profitability index less than 1 suggests that the project might not generate sufficient returns to justify its costs, raising questions about its feasibility.

- Feasibility Determination: The Role of Profitability Index is pivotal in determining project feasibility.

- Reliable Feasibility Indicator: The index acts as a reliable indicator of project feasibility.

- Positive Index Value: An index value greater than 1 indicates potential feasibility.

- Outweighing Inflows: It signifies that expected cash inflows outweigh initial outflows.

- Profitable Venture: A value exceeding 1 suggests a potentially profitable venture.

- Negative Index Value: An index less than 1 raises questions about feasibility.

- Insufficient Returns: It suggests that projected returns might not justify costs.

- Cost-Benefit Assessment: The index aids in assessing the cost-benefit dynamics.

- Prudent Resource Allocation: Decision-makers can allocate resources prudently based on index insights.

- Quantifiable Feasibility: The index quantifies project feasibility on a numerical scale.

- Objective Feasibility Gauge: It provides an objective gauge of feasibility.

- Optimal Resource Deployment: The index guides the optimal deployment of resources.

- Risk Mitigation: It contributes to risk mitigation by assessing feasibility.

- Resource Utilization Clarity: Decision-makers gain clarity on resource utilization viability.

- Strategic Resource Allocation: The index supports strategic resource allocation aligned with feasibility.

- Holistic Feasibility Assessment: It offers a holistic assessment of project feasibility.

- Decision Confidence: Decision-makers can make choices with greater confidence in feasibility.

- Informed Feasibility Analysis: The index drives informed feasibility analysis.

- Investment Direction: It directs investments towards viable endeavors.

- Financial Integrity: The index safeguards financial integrity by assessing feasibility.

- Project Risk Evaluation: It aids in evaluating project risk associated with feasibility.

- Value Over Cost: The index weighs value over cost for feasibility evaluation.

- Quantitative Feasibility Metric: It provides a quantitative metric for feasibility.

- Comparative Feasibility: The index enables comparative feasibility evaluation.

- Strategic Planning Alignment: It aligns feasibility assessment with strategic planning.

- Effective Resource Allocation: The index supports effective resource allocation for feasible projects.

Conclusion: Guiding Investment Decisions

In the dynamic landscape of capital budgeting, the role of profitability index is undeniably significant. It acts as a compass, guiding investment decisions by quantifying the potential profitability of projects. By helping in the capital rationing process, acting as a vital capital budgeting tool, and contributing to project feasibility assessments, the profitability index empowers decision-makers to allocate resources efficiently and strategically. It bridges the gap between quantitative analysis and practical decision-making, enabling businesses to make choices that align with their

financial goals and enhance long-term profitability. As such, the profitability index serves as an indispensable asset in the arsenal of tools used to navigate the complexities of capital budgeting.

Comments are closed!