In the dynamic world of business, making informed decisions about investments and projects is paramount for sustainable growth and profitability. The process of project selection, where organizations choose among various potential ventures, requires a systematic approach to ensure the optimal utilization of resources and alignment with strategic objectives. This essay delves into three prominent Project Selection Methods: Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. These methods serve as compasses guiding organizations toward making sound investment choices and maximizing returns.

Understanding Project Selection Methods

Project Selection Methods encompass a variety of tools and techniques that assist decision-makers in evaluating and comparing potential projects. These methods provide a structured framework for assessing various aspects of a project, such as its financial viability, return potential, and alignment with organizational goals. Among the arsenal of methods available, NPV, IRR, and Payback Period stand out as cornerstones of modern project evaluation.

Project Selection Methods encompass tools and techniques aiding decision-makers in evaluating and comparing projects.

-

These methods offer a structured framework for assessing project aspects:

- Financial viability

- Return potential

- Alignment with organizational goals

-

Prominent methods in this arsenal include:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback Period

Table: Overview of Project Selection Methods

| Method |

Purpose |

Key Focus |

Considerations |

| Net Present Value |

Evaluate profitability |

Future cash flows, time value of money, cost of capital |

Long-term projects, value creation |

| Internal Rate of Return |

Assess return potential |

Rate of return, discount rate |

Projects with varying cash flows |

| Payback Period |

Analyze investment recovery time |

Time to recover initial investment, cash flows |

Projects requiring quick returns |

Net Present Value (NPV)

Role of Project Selection Methods in Decision-Making

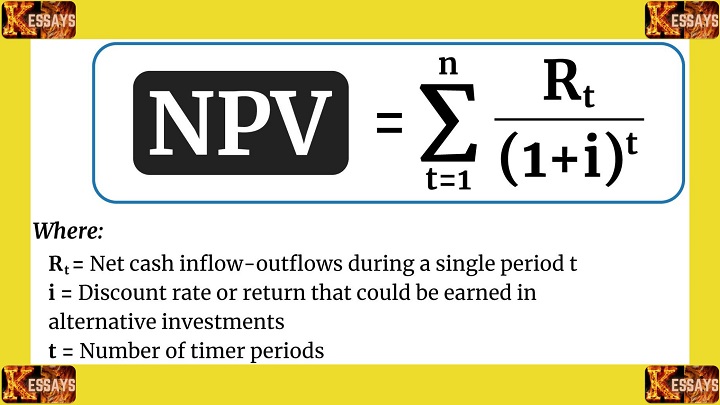

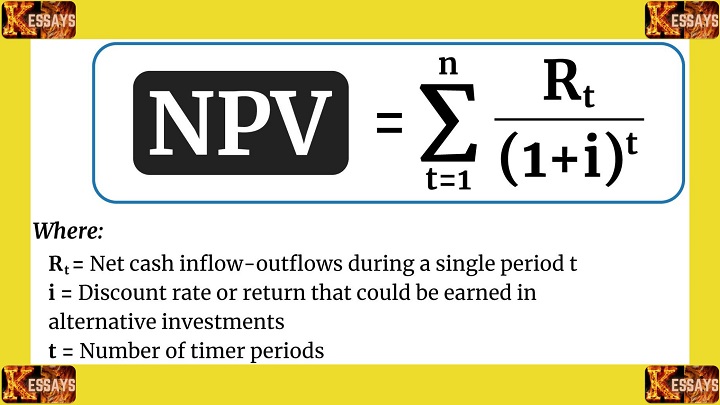

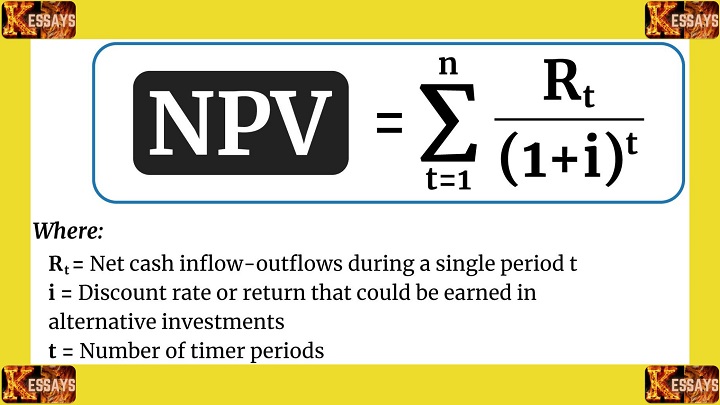

NPV, a key player in the realm of project selection methods, evaluates the profitability of an investment by comparing the present value of expected cash inflows to the present value of cash outflows. This method takes into account the time value of money, ensuring that future cash flows are appropriately discounted. The central aim of NPV is to determine whether an investment will yield positive value after considering the costs and returns over the project's lifecycle.

- NPV, a pivotal method in project selection, evaluates investment profitability.

- Comparing cash flows: Compares present value of expected cash inflows to outflows.

- Time value of money: Incorporates discounted future cash flows.

- Aims to determine if investment yields positive value after accounting for costs and returns over the project's life.

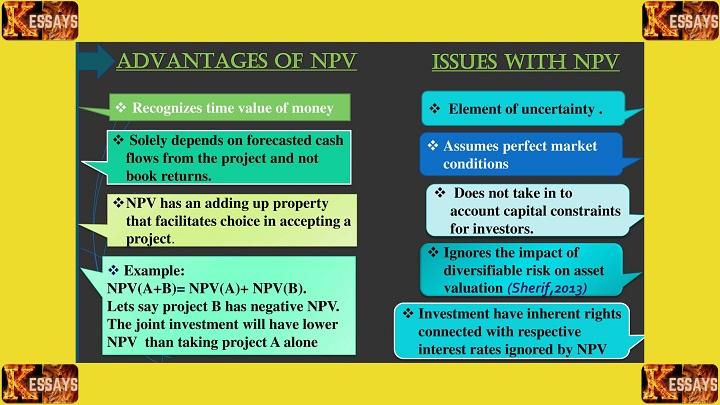

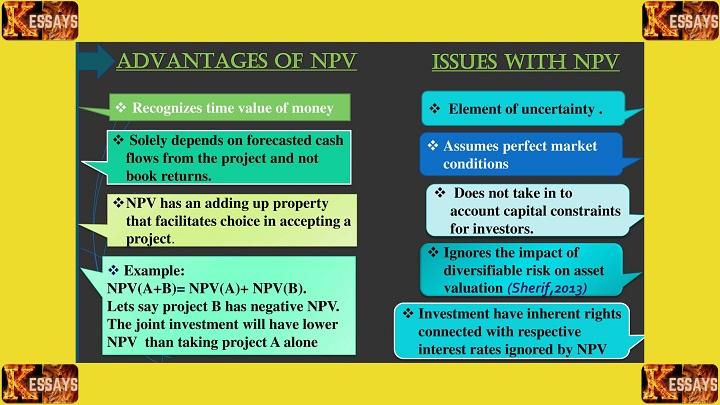

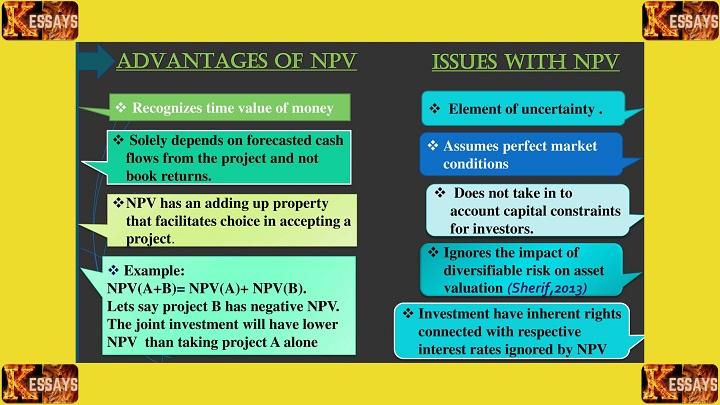

Advantages of NPV

NPV provides a comprehensive assessment of a project's potential by factoring in both the magnitude and timing of cash flows. Its utilization of discounted cash flows enhances accuracy in evaluating long-term investments. By considering the cost of capital, NPV guides organizations toward making decisions that align with shareholder wealth maximization.

- Comprehensive assessment: NPV evaluates a project's potential by considering both magnitude and timing of cash flows.

- Discounted cash flows: Utilizes discounted cash flows for accurate evaluation of long-term investments.

- Cost of capital consideration: Guides decisions aligned with shareholder wealth maximization.

- Provides a quantitative measure for comparing multiple projects based on financial feasibility.

- Takes into account all relevant cash flows, including initial investment and future cash flows.

- Offers an effective tool for strategic resource allocation and investment prioritization.

- Incorporates a holistic approach by considering the entire lifecycle of a project.

- Enables organizations to make informed investment decisions by evaluating potential returns.

- Accounts for the time value of money, addressing the importance of time in financial decision-making.

- Supports organizations in maximizing returns while managing financial risk.

In essence, NPV stands as a fundamental method that aids organizations in making informed investment decisions by assessing the financial feasibility and alignment of projects with long-term strategic goals.

Internal Rate of Return (IRR)

Evaluating Return Potential

Another prominent method is the Internal Rate of Return (IRR), which focuses on assessing the project's potential return rather than its absolute value. IRR is the discount rate that equates the present value of cash inflows with the present value of cash outflows. If the calculated IRR exceeds the required rate of return or cost of capital, the project is deemed acceptable.

- IRR, a significant method, assesses project return potential, not just its absolute value.

- Focus on return: Compares present value of cash inflows to outflows.

- Discount rate: IRR is the rate equating present value of inflows to outflows.

- Acceptance criterion: If calculated IRR surpasses required rate of return or cost of capital, project is acceptable.

Advantages of IRR

IRR simplifies the assessment of potential projects, providing a single metric that conveys the rate of return expected from an investment. It considers the timing of cash flows and is particularly useful when projects involve irregular cash flows or multiple investment options.

- Simplified assessment: Provides single metric indicating expected rate of return.

- Considers cash flow timing: IRR incorporates timing of cash flows.

- Useful for varying cash flows: Particularly effective for projects with irregular cash flows or multiple investment options.

- Easy comparison: Allows straightforward comparison of projects based on their return potential.

Payback Period

Measuring Investment Recovery Time

The Payback Period, a straightforward method, focuses on the time required to recover the initial investment through expected cash inflows. It is the duration within which the cumulative cash inflows equal or exceed the initial investment.

- Payback Period, a simple method, gauges time to recover initial investment from expected cash inflows.

- Time for recovery: Duration in which cumulative cash inflows match or exceed initial investment.

Advantages of Payback Period

Payback Period offers a quick assessment of how soon an organization can recoup its investment, providing insights into liquidity and risk. It is particularly useful for projects where quick returns are essential.

- Quick assessment: Provides speedy insight into investment recoupment time.

- Liquidity and risk: Offers understanding of liquidity and risk associated with investment.

- Useful for quick returns: Particularly valuable for projects requiring swift returns on investment.

- Easy comparison: Allows straightforward comparison of projects based on recovery time.

Comparing the Methods

Informed Decision-Making

Each of these Project Selection Methods offers distinct advantages and insights. NPV emphasizes value creation, considering the time value of money and cost of capital. IRR emphasizes the return potential, offering a percentage return on investment. Payback Period focuses on liquidity and investment recovery time. The choice among these methods depends on the organization's priorities and the nature of the projects being evaluated.

-

Net Present Value (NPV):

- Emphasizes value creation.

- Considers time value of money and cost of capital.

- Provides a comprehensive assessment of potential projects.

-

Internal Rate of Return (IRR):

- Emphasizes return potential.

- Offers a percentage return on investment.

- Useful for projects with irregular cash flows.

-

Payback Period:

- Focuses on liquidity and investment recovery time.

- Provides quick assessment of time to recover initial investment.

- Particularly useful for projects requiring quick returns.

Table: Comparison of Project Selection Methods

| Method |

Emphasis |

Key Considerations |

Applicability |

| Net Present Value |

Value creation |

Time value of money, cost of capital |

Diverse projects, long-term |

| Internal Rate of Return |

Return potential |

Percentage return on investment |

Projects with irregular cash flows |

| Payback Period |

Liquidity, recovery time |

Time to recover initial investment, cash flows |

Projects needing quick returns |

Conclusion

In the intricate landscape of project selection, these three methods—NPV, IRR, and Payback Period—serve as guiding stars, illuminating the path toward sound investment choices. The decision to undertake a project can significantly impact an organization's financial health, growth trajectory, and competitive edge. By employing these methods, decision-makers can ensure that their choices are grounded in financial rationale, align with strategic objectives, and maximize returns, ultimately leading to long-term success and prosperity.

Comments are closed!